sam altman says investors are acting irrational — OpenAI CEO Sam Altman has expressed concerns about the current state of AI investments, likening it to the dot-com bubble of the late 1990s..

Sam Altman Says Investors Are Acting Irrational

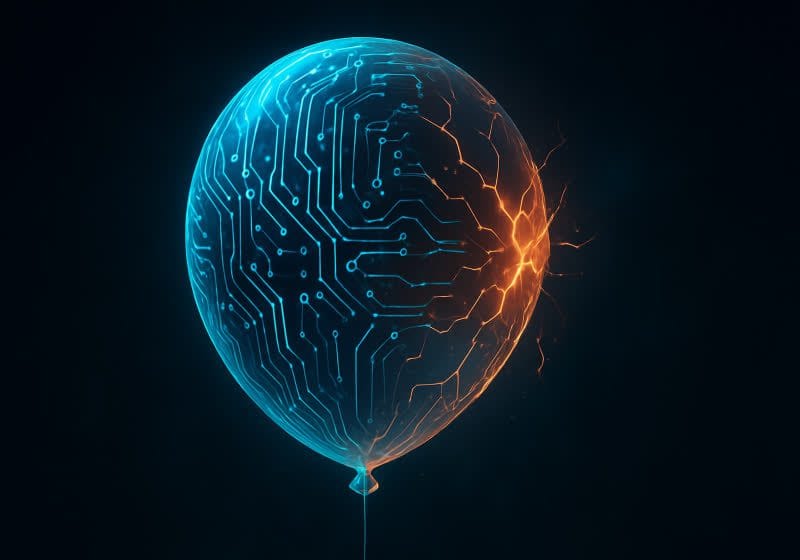

OpenAI CEO Sam Altman has expressed concerns about the current state of AI investments, likening it to the dot-com bubble of the late 1990s.

Sam Altman Highlights AI Investment Bubble

In a recent dinner interview with reporters in San Francisco, Sam Altman, the CEO of OpenAI, shared insights about the ongoing investment landscape in the artificial intelligence (AI) sector. His remarks have drawn attention from economists and industry analysts alike, as he pointed out that the AI market is experiencing a bubble driven by overly enthusiastic investors.

Comparison to the Dot-Com Bubble

Altman drew parallels between the current AI investment frenzy and the dot-com bubble that characterized the late 1990s. During that period, many internet companies saw their valuations soar, often without a sustainable business model to support them. Similarly, Altman noted that many AI startups are attracting significant funding based on hype rather than solid fundamentals.

Investor Behavior

According to Altman, the behavior of investors in the AI sector is increasingly irrational. He emphasized that while AI has transformative potential, the current excitement may lead to inflated valuations and unrealistic expectations. This could pose risks not only to investors but also to the broader tech ecosystem.

Potential Consequences

As the AI sector continues to grow, Altman cautioned that an eventual market correction could result in significant losses for those who invested during this speculative phase. He urged investors to adopt a more measured approach, focusing on companies with viable business models and long-term strategies rather than succumbing to the prevailing hype.

The Future of AI Investments

Despite his concerns, Altman remains optimistic about the future of AI technology. He believes that the sector has the potential to revolutionize various industries, from healthcare to finance. However, he reiterated the importance of sustainable growth and responsible investment practices to ensure that the industry can realize its full potential without falling prey to the pitfalls of speculation.

In conclusion, as the AI landscape continues to evolve, it is crucial for investors to remain vigilant and discerning. The lessons learned from past bubbles, such as the dot-com era, should serve as a reminder of the importance of grounded investment strategies in a rapidly changing technological environment.

Source: Original reporting

Further reading: related insights.

Was this helpful?

Last Modified: August 17, 2025 at 2:14 pm

7 views