preparing for your later-stage raise insider strategies Investors and entrepreneurs gathered at TechCrunch Disrupt 2025 to discuss strategies for successfully navigating later-stage fundraising, with insights from prominent figures in the venture capital landscape.

preparing for your later-stage raise insider strategies

Understanding the Later-Stage Fundraising Landscape

As startups evolve, the need for substantial capital becomes increasingly critical, particularly during Series C rounds and beyond. This stage of fundraising is not merely about securing funds; it is about demonstrating growth, scalability, and a clear path to profitability. The insights shared by industry leaders at TechCrunch Disrupt 2025 provide a roadmap for entrepreneurs aiming to attract the right investors and secure the necessary capital to propel their businesses forward.

The Importance of Timing

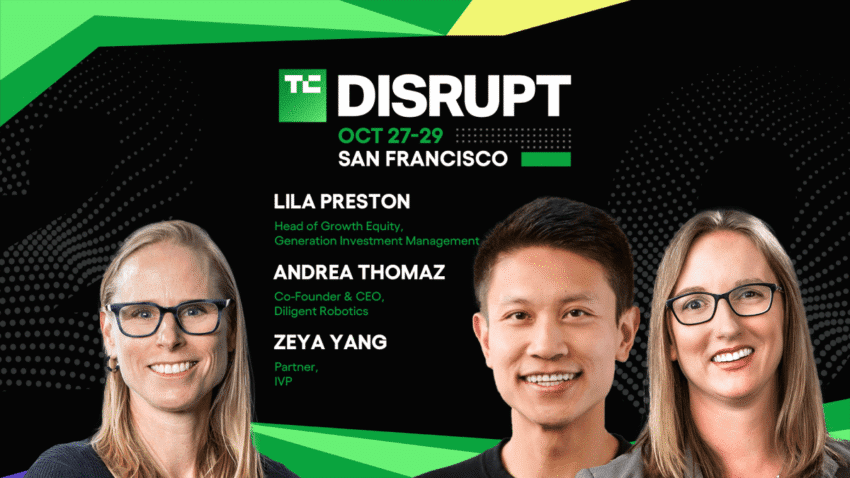

One of the key themes discussed was the importance of timing in the fundraising process. Zeya Yang, a partner at IVP, emphasized that understanding market conditions and investor sentiment can significantly impact the success of a fundraising round. “Timing is everything,” Yang stated, noting that entrepreneurs should be aware of macroeconomic factors that could influence investor decisions. For instance, during periods of economic uncertainty, investors may be more cautious, making it essential for startups to present a compelling case for why they are a worthwhile investment.

Building a Strong Narrative

Another critical aspect of preparing for a later-stage raise is crafting a compelling narrative. Lila Preston from Generation highlighted the need for entrepreneurs to articulate their vision clearly. “Investors want to understand not just what you do, but why you do it,” she explained. A strong narrative helps to differentiate a startup from its competitors and can create an emotional connection with potential investors. This connection is often what drives investors to choose one startup over another, especially in crowded markets.

Demonstrating Traction and Metrics

Investors are increasingly focused on data-driven decision-making. Andrea Thomaz of Diligent Robotics pointed out that demonstrating traction through key performance indicators (KPIs) is essential for later-stage fundraising. “You need to show that you have a product-market fit and that your business model is scalable,” Thomaz noted. Startups should prepare to present metrics such as revenue growth, customer acquisition costs, and retention rates. These figures not only validate the business model but also instill confidence in investors regarding the startup’s potential for future growth.

Engaging with Investors

Engagement with potential investors is another crucial element of the fundraising process. The panelists discussed various strategies for building relationships with investors before the actual fundraising round begins. Yang suggested that entrepreneurs should start networking early, even before they are ready to raise funds. “Building relationships takes time,” he said. “You want investors to know you and your business long before you ask them for money.”

Leveraging Existing Networks

Preston added that leveraging existing networks can be beneficial in this regard. “Tap into your advisors, mentors, and even current investors to make introductions,” she recommended. This approach can help entrepreneurs gain access to a broader pool of potential investors and can also lend credibility to their fundraising efforts. Additionally, having a warm introduction can often lead to more productive conversations than cold outreach.

Preparing for Due Diligence

As startups prepare for a later-stage raise, they must also be ready for the due diligence process. This phase can be daunting, but being well-prepared can significantly ease the burden. Thomaz advised entrepreneurs to have all necessary documentation organized and readily available. “Investors will want to see everything from financial statements to legal documents,” she said. “Being organized shows that you are serious about your business and respect their time.”

Understanding Investor Expectations

Each investor has unique expectations and criteria for evaluating potential investments. Understanding these can help entrepreneurs tailor their pitches effectively. Yang noted that different investors may prioritize various aspects of a business, such as technology, market size, or team composition. “Do your homework on your potential investors,” he advised. “Know what they care about and align your pitch accordingly.”

Aligning with Investor Values

Preston emphasized the importance of aligning with investor values, particularly for those seeking impact-driven investments. “Many investors today are looking for more than just financial returns; they want to invest in companies that align with their values,” she explained. Startups that can demonstrate a commitment to social responsibility or sustainability may find it easier to attract investors who share those priorities.

Creating a Compelling Pitch Deck

A well-crafted pitch deck is a vital tool in the fundraising process. The panelists shared tips for creating an effective pitch deck that resonates with investors. Thomaz recommended focusing on clarity and conciseness. “Investors see countless pitch decks; you need to make yours stand out,” she said. Key elements to include are:

- Company overview and mission

- Market analysis and competitive landscape

- Business model and revenue streams

- Traction and growth metrics

- Team background and expertise

- Funding requirements and use of proceeds

Each slide should tell a part of the overall story, leading investors through the narrative in a logical and engaging manner.

Post-Funding Strategies

Securing funding is just the beginning. The panelists also discussed strategies for effectively utilizing the capital raised. Yang highlighted the importance of setting clear goals for the use of funds. “Investors want to see that you have a plan for how you will deploy their capital,” he stated. This includes not only growth initiatives but also operational improvements and team expansion.

Communicating with Investors

Maintaining open lines of communication with investors post-funding is crucial. Preston noted that regular updates can help build trust and keep investors engaged. “Share your progress, challenges, and milestones,” she advised. This transparency can foster a positive relationship and may even lead to additional funding opportunities in the future.

Preparing for Future Rounds

Finally, the panelists emphasized the importance of preparing for future funding rounds. Startups should view each fundraising effort as part of a larger journey. Thomaz suggested that entrepreneurs continuously refine their business strategies and adapt to changing market conditions. “The landscape is always evolving, and you need to be agile,” she said. This adaptability can position startups favorably for subsequent rounds of funding.

Conclusion

As the landscape for later-stage fundraising continues to evolve, the insights shared at TechCrunch Disrupt 2025 serve as a valuable guide for entrepreneurs. By understanding the importance of timing, building strong narratives, demonstrating traction, and engaging effectively with investors, startups can enhance their chances of securing the funding needed to scale their businesses. The journey of fundraising is complex, but with the right strategies and preparation, entrepreneurs can navigate it successfully.

Source: Original report

Was this helpful?

Last Modified: September 12, 2025 at 10:42 pm

2 views