perfect your pitch investors share what really At TechCrunch Disrupt 2025, industry leaders shared invaluable insights on what makes a startup pitch truly stand out to investors.

perfect your pitch investors share what really

Understanding the Pitch Landscape

In the competitive world of startups, the ability to deliver a compelling pitch can be the difference between securing funding and facing closure. As the startup ecosystem evolves, so do the expectations of investors. At TechCrunch Disrupt 2025, held from October 27 to 29 in San Francisco, three prominent figures in the venture capital space—Medha Agarwal from Defy.vc, Jyoti Bansal, CEO of Harness, and Jennifer Neundorfer from January Ventures—came together to discuss the nuances of effective pitching.

Their discussion illuminated key elements that can help founders capture the attention of investors, emphasizing that a successful pitch is not merely about presenting a business idea but rather about telling a story that resonates with potential backers.

The Art of Storytelling

One of the most significant takeaways from the panel was the importance of storytelling in a pitch. Medha Agarwal emphasized that investors are not just looking for numbers; they want to connect with the founder’s vision. “A great pitch tells a story that engages the audience emotionally,” she noted. “It’s about painting a picture of the problem you’re solving and why it matters.”

This approach requires founders to articulate their mission clearly and passionately. By framing their startup within a narrative that highlights the problem, solution, and impact, entrepreneurs can create a memorable pitch that lingers in the minds of investors long after the presentation.

Crafting a Compelling Narrative

To craft a compelling narrative, founders should consider the following elements:

- Problem Identification: Clearly define the problem your startup addresses. Investors want to understand the pain points that your solution alleviates.

- Solution Presentation: Describe how your product or service solves the identified problem. This is where you showcase your unique value proposition.

- Market Opportunity: Provide insights into the market size and potential for growth. Investors are interested in the scalability of your solution.

- Team Dynamics: Highlight the strengths and experiences of your team. Investors often invest in people as much as they do in ideas.

- Vision for the Future: Share your long-term vision and how you plan to achieve it. This gives investors a sense of direction and purpose.

Authenticity and Passion

Another crucial aspect discussed was the need for authenticity and passion in a pitch. Jyoti Bansal stressed that investors can quickly sense when a founder is not genuine. “You need to be authentic and passionate about what you’re doing,” Bansal remarked. “If you don’t believe in your product, why should anyone else?”

This authenticity can manifest in various ways, from the founder’s demeanor to their willingness to share personal anecdotes related to their entrepreneurial journey. When founders are open about their motivations and challenges, it fosters a deeper connection with investors, making them more likely to support the venture.

Building Trust Through Transparency

Transparency is another critical factor in establishing trust with potential investors. Founders should be prepared to discuss not only their successes but also their failures and lessons learned. Jennifer Neundorfer highlighted that acknowledging challenges demonstrates resilience and a willingness to adapt. “Investors appreciate when founders are honest about their journey,” she explained. “It shows that you’re not just in it for the glory but are committed to building something meaningful.”

Data-Driven Decision Making

While storytelling and authenticity are vital, the panelists also underscored the importance of data in a pitch. Investors want to see that founders are making data-driven decisions. “You need to back up your claims with solid data,” Agarwal advised. “Whether it’s user metrics, revenue projections, or market research, data adds credibility to your narrative.”

Founders should be prepared to present key performance indicators (KPIs) that demonstrate traction and growth potential. This could include user acquisition rates, customer retention statistics, and financial forecasts. By combining compelling storytelling with robust data, founders can create a well-rounded pitch that appeals to both the emotional and rational sides of investors.

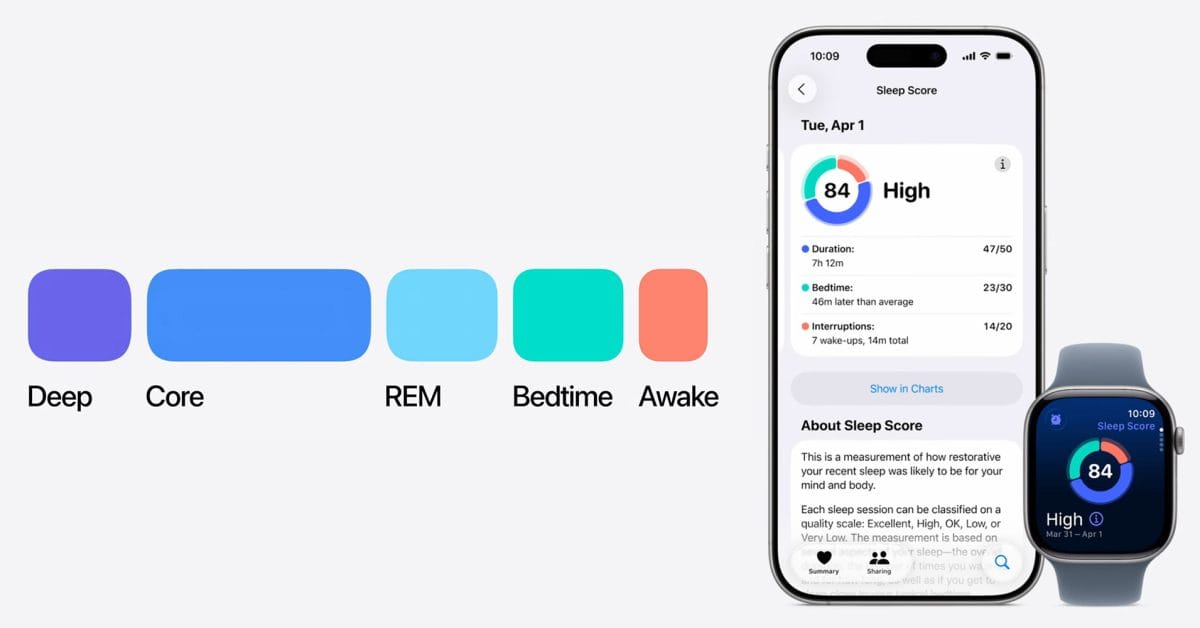

Visual Aids and Presentation Style

The use of visual aids can significantly enhance a pitch. Bansal emphasized that well-designed slides can help convey complex information more effectively. “Visuals should complement your story, not overwhelm it,” he noted. “Keep slides clean and focused on key points.”

Additionally, the delivery style plays a crucial role in how the pitch is received. Founders should practice their presentations to ensure they are confident and engaging. Neundorfer suggested that founders rehearse in front of peers to receive constructive feedback. “The more you practice, the more natural it will feel,” she said. “Confidence can make a significant difference in how your message is perceived.”

Engaging with Investors

Engagement during the pitch is essential. Founders should be prepared for questions and discussions that may arise. Agarwal noted that investors often ask probing questions to gauge a founder’s depth of knowledge and commitment. “Be ready to dive deeper into your business model, market strategy, and financial projections,” she advised.

Moreover, founders should view the pitch as a two-way conversation rather than a one-sided presentation. Engaging with investors can provide valuable insights and feedback, which can be beneficial for refining the business model or addressing potential concerns.

Follow-Up Strategies

After the pitch, the follow-up is equally important. Neundorfer emphasized the need for timely and thoughtful follow-ups. “Send a thank-you note, and if you promised additional information, make sure to provide it promptly,” she said. “This shows professionalism and respect for the investor’s time.”

Additionally, founders should keep investors updated on their progress, even if they do not secure funding immediately. Building a relationship over time can lead to future opportunities, as investors appreciate founders who demonstrate persistence and growth.

Conclusion: The Road Ahead

The insights shared by Medha Agarwal, Jyoti Bansal, and Jennifer Neundorfer at TechCrunch Disrupt 2025 provide a roadmap for founders looking to refine their pitch strategies. By focusing on storytelling, authenticity, data-driven decision-making, and effective engagement, entrepreneurs can significantly enhance their chances of attracting investment.

As the startup landscape continues to evolve, the ability to adapt and learn from feedback will be crucial for founders. The journey of entrepreneurship is often fraught with challenges, but with the right approach to pitching, founders can navigate these hurdles and turn their visions into reality.

Source: Original report

Was this helpful?

Last Modified: September 10, 2025 at 9:44 pm

4 views