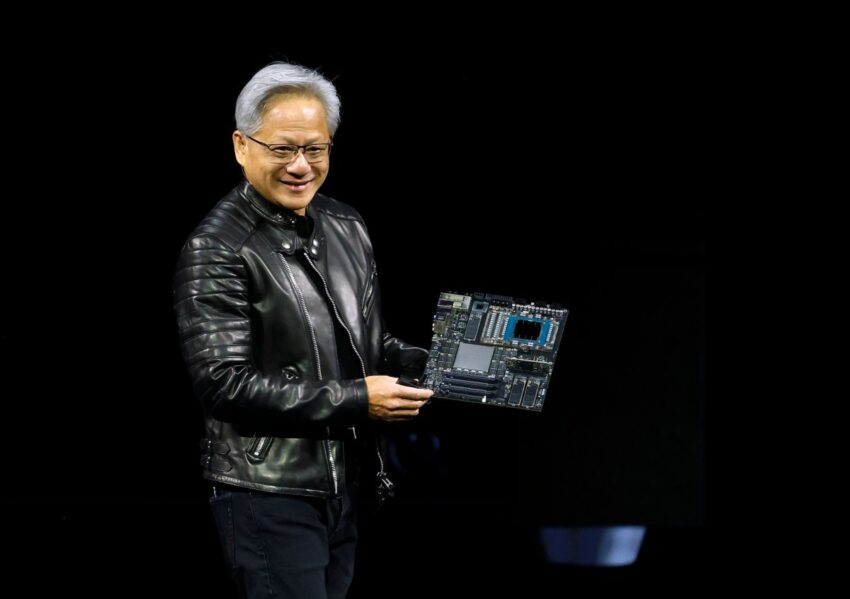

nvidia s record 57b revenue and upbeat Nvidia has reported a record revenue of $57 billion for the fiscal year, a significant achievement that has helped to quell discussions surrounding a potential AI bubble.

nvidia s record 57b revenue and upbeat

Overview of Nvidia’s Financial Performance

Nvidia’s financial results for the fiscal year have exceeded analysts’ expectations, showcasing the company’s strong position in the technology sector. The $57 billion revenue marks a substantial increase from the previous year, driven primarily by the booming demand for artificial intelligence (AI) technologies and data center solutions. This financial performance has led to a reassessment of the sustainability of AI investments and the overall health of the tech market.

Data Center Business as a Revenue Driver

The data center segment has been the cornerstone of Nvidia’s financial success. This division accounted for a significant portion of the company’s revenue, reflecting the increasing reliance on cloud computing and AI applications across various industries. Companies are investing heavily in AI capabilities, and Nvidia’s GPUs are at the forefront of this technological shift.

In the past year, Nvidia’s data center revenue surged, driven by the growing adoption of AI models that require substantial computational power. Major tech companies, including Google, Microsoft, and Amazon, have expanded their AI offerings, leading to increased demand for Nvidia’s hardware. The company’s GPUs are essential for training and deploying AI models, making them a critical component in the infrastructure of modern data centers.

AI Demand and Market Implications

The surge in demand for AI technologies has raised questions about the potential for an AI bubble. However, Nvidia’s robust financial results suggest that the growth in this sector is not merely speculative. The company’s ability to generate significant revenue from its data center business indicates a solid foundation for continued growth in AI.

Analysts have noted that the demand for AI is not limited to a few tech giants; it is spreading across various sectors, including healthcare, finance, and manufacturing. As organizations seek to leverage AI for competitive advantage, the need for powerful computing resources will likely continue to rise. This trend positions Nvidia favorably in the market, as it remains a leading provider of the necessary hardware.

Future Outlook and Strategic Initiatives

Nvidia’s optimistic forecast for the upcoming fiscal year further underscores its confidence in the AI market. The company anticipates continued growth in its data center business, driven by ongoing investments in AI infrastructure and the expansion of its product offerings. Nvidia’s strategic initiatives, including partnerships and acquisitions, are designed to enhance its capabilities and maintain its competitive edge.

Partnerships and Collaborations

Nvidia has been proactive in forming partnerships with various organizations to bolster its AI ecosystem. Collaborations with cloud service providers and research institutions have allowed Nvidia to stay at the forefront of AI innovation. These partnerships enable the company to develop cutting-edge technologies and provide customers with comprehensive solutions tailored to their specific needs.

For instance, Nvidia’s collaboration with major cloud providers has facilitated the integration of its GPUs into their platforms, making it easier for businesses to access powerful AI tools. This accessibility is crucial for organizations looking to implement AI solutions without the need for extensive in-house infrastructure.

Investment in Research and Development

To maintain its leadership position, Nvidia continues to invest heavily in research and development (R&D). The company is focused on advancing its GPU technology and exploring new applications for AI. This commitment to innovation is essential for staying ahead of competitors and meeting the evolving demands of the market.

Nvidia’s R&D efforts are not only aimed at improving existing products but also at exploring new frontiers in AI. The company is actively researching areas such as autonomous vehicles, robotics, and edge computing, which have the potential to drive future growth. By diversifying its portfolio, Nvidia aims to mitigate risks associated with reliance on a single market segment.

Stakeholder Reactions and Market Sentiment

The positive financial results and outlook have elicited favorable reactions from stakeholders, including investors, analysts, and industry experts. Nvidia’s stock price has seen a significant increase following the announcement of its earnings, reflecting renewed confidence in the company’s growth trajectory.

Investor Confidence

Investors have responded positively to Nvidia’s strong performance, with many expressing optimism about the company’s future prospects. The record revenue has alleviated concerns about a potential AI bubble, as it demonstrates that the demand for AI technologies is grounded in real market needs rather than speculative hype.

Furthermore, analysts have revised their price targets for Nvidia’s stock, citing the company’s robust fundamentals and growth potential. This shift in sentiment is indicative of a broader recognition of the value that Nvidia brings to the AI landscape.

Industry Expert Opinions

Industry experts have also weighed in on Nvidia’s performance, highlighting the company’s pivotal role in shaping the future of AI. Many believe that Nvidia’s innovations will continue to drive advancements in AI technology, making it a key player in the ongoing digital transformation across various sectors.

Experts have noted that Nvidia’s ability to adapt to changing market dynamics and invest in emerging technologies positions it well for sustained growth. As AI continues to evolve, Nvidia’s commitment to innovation and strategic partnerships will likely play a crucial role in its success.

Conclusion: A Bright Future for Nvidia and AI

Nvidia’s record revenue of $57 billion and its optimistic forecast signal a robust future for the company and the AI industry as a whole. The strong performance of its data center business underscores the increasing demand for AI technologies, dispelling fears of an impending bubble.

As organizations across various sectors continue to invest in AI capabilities, Nvidia is well-positioned to capitalize on this trend. Its strategic initiatives, including partnerships and R&D investments, will further enhance its competitive advantage and drive future growth.

In summary, Nvidia’s financial success not only reflects its strong market position but also highlights the transformative potential of AI technologies. As the company continues to innovate and expand its offerings, it is likely to remain a key player in the tech landscape for years to come.

Source: Original report

Was this helpful?

Last Modified: November 20, 2025 at 6:37 am

2 views