lux capital lands 1 5b for its Lux Capital has successfully raised $1.5 billion for its largest fund to date, marking a significant milestone in the venture capital landscape.

lux capital lands 1 5b for its

Overview of Lux Capital

Founded 25 years ago, Lux Capital has established itself as a prominent player in the venture capital sector, focusing on emerging technologies and innovative startups. The firm has a reputation for identifying and investing in groundbreaking companies that are poised to disrupt traditional industries. With a keen eye for potential, Lux Capital has made early investments in notable firms such as Anduril, Applied Intuition, and Runway AI, which have since gained traction and recognition in their respective fields.

Investment Philosophy

Lux Capital’s investment philosophy is rooted in a belief that technology can solve some of the world’s most pressing challenges. The firm seeks to back visionary entrepreneurs who are not only building innovative products but are also committed to making a positive impact on society. This approach has allowed Lux to cultivate a diverse portfolio that spans various sectors, including defense, artificial intelligence, and biotechnology.

Notable Investments

Among the firm’s most significant investments is Anduril, a defense technology company that develops advanced systems for national security. Anduril’s innovative solutions, such as autonomous drones and surveillance systems, have garnered attention from government agencies and defense contractors alike. Lux Capital’s early backing has been instrumental in helping Anduril scale its operations and expand its market presence.

Another noteworthy investment is Applied Intuition, a company focused on providing software tools for the autonomous vehicle industry. As the demand for self-driving technology continues to grow, Applied Intuition has positioned itself as a critical player in this space, offering solutions that enhance safety and efficiency in autonomous systems. Lux Capital’s investment has enabled the company to further develop its technology and attract additional clients.

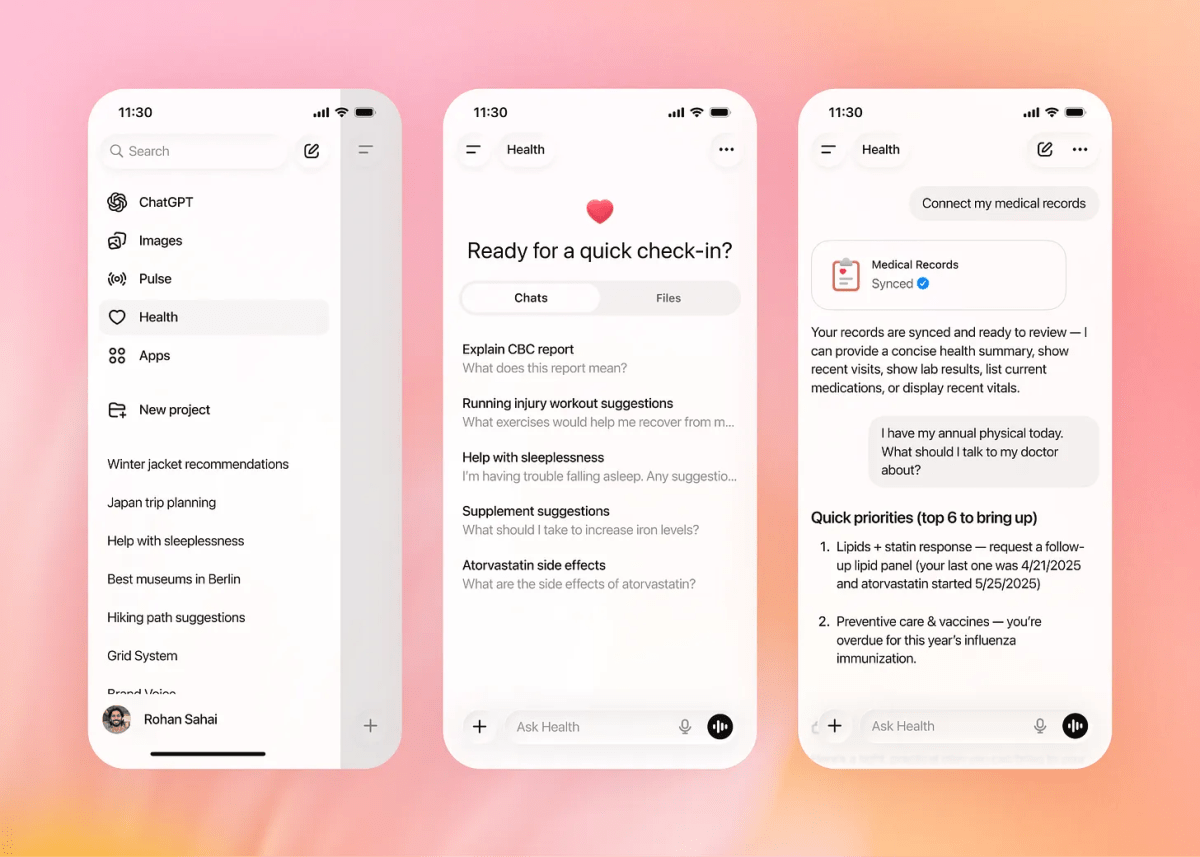

Runway AI is yet another example of Lux Capital’s forward-thinking investment strategy. This startup specializes in artificial intelligence tools for creative professionals, allowing users to generate high-quality content quickly and efficiently. As the creative industry increasingly embraces AI, Runway AI’s innovative offerings have the potential to reshape how content is produced, making Lux Capital’s investment particularly timely.

Significance of the $1.5 Billion Fund

The recent $1.5 billion fund is a testament to Lux Capital’s growing influence and the increasing interest in venture capital investments. This fund will enable the firm to expand its reach and invest in a broader range of startups that align with its mission of fostering innovation. The size of this fund positions Lux Capital as a formidable player in the venture capital arena, allowing it to compete with larger firms and attract top-tier entrepreneurs.

Market Trends and Implications

The venture capital landscape has evolved significantly in recent years, with an increasing number of investors looking to capitalize on emerging technologies. The COVID-19 pandemic accelerated the adoption of digital solutions across various sectors, leading to a surge in demand for innovative startups. As a result, venture capital firms are under pressure to identify and invest in companies that can thrive in this rapidly changing environment.

Lux Capital’s $1.5 billion fund comes at a time when many investors are seeking to diversify their portfolios and mitigate risks associated with market volatility. By focusing on sectors such as defense, AI, and biotechnology, Lux Capital is positioning itself to capitalize on trends that are likely to shape the future of the global economy.

Stakeholder Reactions

The announcement of the $1.5 billion fund has garnered positive reactions from various stakeholders within the venture capital community. Industry experts have praised Lux Capital for its ability to attract significant capital, highlighting the firm’s track record of successful investments and its commitment to supporting innovative entrepreneurs.

Entrepreneurs and startups are also expressing enthusiasm about the potential opportunities that Lux Capital’s new fund will create. With increased capital at its disposal, the firm will be able to provide more resources and support to its portfolio companies, helping them navigate the challenges of scaling their operations and bringing their products to market.

Future Outlook

Looking ahead, Lux Capital’s $1.5 billion fund positions the firm for continued success in the venture capital space. The firm plans to leverage this capital to invest in a diverse array of startups that are at the forefront of technological innovation. By maintaining its focus on sectors that align with its mission, Lux Capital aims to drive meaningful change and contribute to the advancement of society.

Challenges Ahead

Despite the positive outlook, Lux Capital and other venture capital firms face several challenges in the coming years. The competitive landscape for investment opportunities is intensifying, with more firms vying for a limited pool of high-potential startups. Additionally, economic uncertainties and potential regulatory changes could impact the venture capital ecosystem, making it crucial for firms to remain agile and adaptable.

Conclusion

Lux Capital’s successful raise of $1.5 billion for its largest fund ever underscores the firm’s commitment to fostering innovation and supporting visionary entrepreneurs. As the venture capital landscape continues to evolve, Lux Capital is well-positioned to capitalize on emerging trends and drive meaningful change across various sectors. The firm’s strategic investments in companies like Anduril, Applied Intuition, and Runway AI highlight its ability to identify and support transformative technologies that have the potential to reshape industries and improve lives.

Source: Original report

Was this helpful?

Last Modified: January 8, 2026 at 11:42 am

2 views