big tech tax breaks could ve funded Senator Elizabeth Warren’s recent analysis reveals that substantial tax breaks for major tech companies could have funded critical benefits for millions of Americans.

big tech tax breaks could ve funded

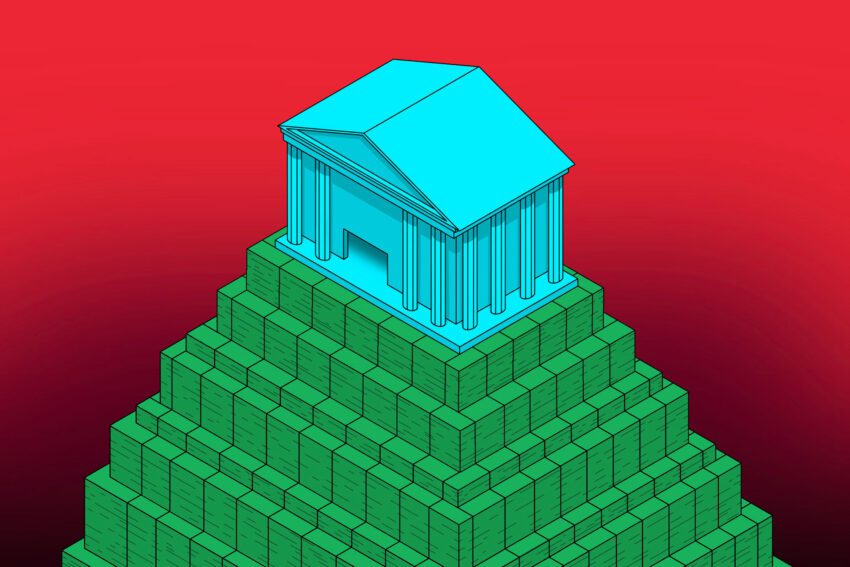

Overview of Tax Breaks for Big Tech

In July, the Republican-controlled Congress passed a significant budget bill, often referred to as President Donald Trump’s “Big Beautiful Bill.” This legislation is characterized by its extensive tax breaks for large corporations, particularly in the technology sector. According to an analysis from Senator Warren’s office, the financial implications of these tax breaks are staggering, with major companies like Alphabet, Amazon, and Microsoft set to benefit immensely.

Alphabet’s Tax Savings

Alphabet, the parent company of Google, is projected to save approximately $17.9 billion in taxes this year alone. This figure is not merely a number; it represents a potential lifeline for millions of Americans. Warren’s office calculated that this amount could fund Supplemental Nutrition Assistance Program (SNAP) benefits for around 7.5 million individuals. SNAP is a vital program that assists low-income families in purchasing food, and the funding from Alphabet’s tax savings could significantly alleviate food insecurity for many.

Amazon’s Tax Breaks

Similarly, Amazon is expected to receive a substantial tax break of about $15.7 billion this year. This amount could provide SNAP benefits for an additional 6.6 million Americans or cover Medicaid for approximately 2 million adults. Medicaid is crucial for low-income individuals and families, providing essential healthcare services. The potential impact of Amazon’s tax savings on public health and nutrition is profound, highlighting the stark contrast between corporate tax relief and the needs of vulnerable populations.

Microsoft’s Future Tax Cuts

Looking ahead, Microsoft is projected to benefit from an estimated $12.5 billion tax cut in 2026. Warren’s analysis suggests that this amount could lower Affordable Care Act (ACA) premiums for around 1.9 million people. The ACA has been instrumental in expanding healthcare access to millions of Americans, and any reduction in premiums could make a significant difference for families struggling to afford health insurance.

Implications of the Tax Breaks

The implications of these tax breaks extend beyond the immediate financial figures. They reflect a broader trend in U.S. fiscal policy, where substantial tax cuts for corporations often come at the expense of essential social programs. The budget bill not only maintains a lower corporate tax rate but also introduces a more generous research and development write-off system. This approach prioritizes corporate interests over the welfare of American families, raising questions about the long-term sustainability of such policies.

Funding for SNAP and Other Programs

To put these tax breaks into context, the federal government spent $99.8 billion last year to fund SNAP benefits for an average of 41.7 million people each month. This expenditure underscores the importance of the program in combating food insecurity. However, with the government currently facing a shutdown, President Trump has stated that he will only partially fund SNAP with a $4.65 billion payment. This decision has raised concerns about the future of food assistance for millions of Americans who rely on these benefits to feed their families.

Political Reactions

Senator Warren has been vocal in her criticism of the current administration’s priorities. In a statement provided to The Verge, she expressed her discontent with the way tax cuts are being allocated. “Donald Trump and Republicans in Congress are knocking millions of Americans off their health insurance and ripping away food assistance from families — all so they can fund giant tax cuts for billionaires and giant corporations,” Warren stated. Her remarks highlight the growing divide between corporate interests and the needs of everyday Americans.

Democratic Response

Warren’s comments reflect a broader Democratic narrative that emphasizes the need for policies that prioritize working families over wealthy corporations. The Democratic Party has been increasingly vocal about the need for reform in the tax code, advocating for a more equitable distribution of resources. This perspective is rooted in the belief that government should serve the interests of all citizens, not just a select few.

Broader Context of Tax Policy

The current landscape of tax policy in the United States raises critical questions about the role of government in addressing social issues. The trend of providing tax breaks to large corporations has been a contentious topic for years, with advocates arguing that such measures stimulate economic growth and job creation. However, critics contend that these policies disproportionately benefit the wealthy while neglecting the needs of low-income families.

Historical Perspective

Historically, tax cuts for corporations have been justified as a means to encourage investment and innovation. Proponents argue that by allowing companies to retain more of their earnings, they can reinvest in their businesses, leading to job creation and economic expansion. However, the reality often falls short of these promises, as many corporations use their tax savings for stock buybacks and executive bonuses rather than investing in their workforce.

Impact on Social Programs

The impact of corporate tax breaks on social programs cannot be overstated. As funding for essential services like SNAP, Medicaid, and the ACA is cut or limited, millions of Americans face increased hardship. The juxtaposition of corporate tax savings against the backdrop of struggling social programs raises ethical questions about the priorities of lawmakers and the effectiveness of current fiscal policies.

Future Considerations

As the debate over tax policy continues, it is essential for lawmakers to consider the long-term implications of their decisions. The current trajectory of prioritizing corporate tax breaks over social welfare programs may lead to increased inequality and social unrest. Policymakers must grapple with the challenge of balancing the needs of corporations with the fundamental rights of citizens to access food, healthcare, and other essential services.

Potential Reforms

In light of these challenges, potential reforms to the tax code could include measures aimed at increasing the tax burden on large corporations while providing additional support for low-income families. Such reforms could take the form of closing loopholes, implementing a minimum corporate tax rate, or increasing taxes on wealthier individuals. These changes could help to redistribute resources more equitably and ensure that all Americans have access to the support they need.

Conclusion

Senator Elizabeth Warren’s analysis of the tax breaks for Big Tech companies underscores a critical issue in American fiscal policy. The substantial savings for corporations like Alphabet, Amazon, and Microsoft could have funded vital social programs that support millions of Americans. As the government grapples with budgetary constraints and the ongoing impacts of the pandemic, the need for a reevaluation of priorities has never been more urgent. The decisions made today will shape the future of social welfare in the United States and determine whether the needs of working families are adequately addressed.

Source: Original report

Was this helpful?

Last Modified: November 7, 2025 at 8:36 pm

0 views