apple card adds new 3 daily cash Apple Card has introduced an enticing new benefit for its users, enhancing the value of its offerings in the competitive credit card market.

apple card adds new 3 daily cash

Introduction of Hertz as a New Partner

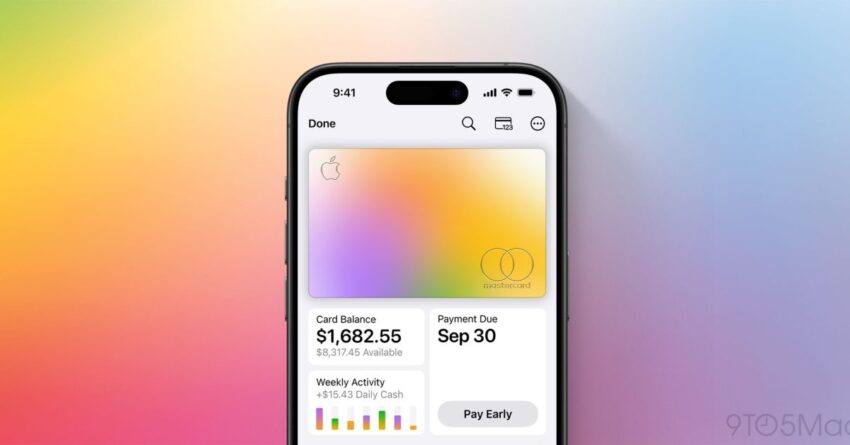

In a recent announcement, Apple revealed that the Apple Card will now provide cardholders with 3% Daily Cash back on car rentals through Hertz. This partnership marks a significant addition to the Apple Card’s existing rewards program, which has been designed to offer users a variety of cash-back opportunities across different spending categories.

Details of the New Perk

The new 3% Daily Cash back on Hertz rentals is a notable enhancement for Apple Card users who frequently rent vehicles. This benefit not only incentivizes users to choose Hertz for their car rental needs but also aligns with Apple’s strategy to create a more comprehensive ecosystem around its financial products. Alongside the cash-back incentive, Apple Card users will also enjoy lower rental rates and complimentary emergency services, further enhancing the value proposition of using the card for car rentals.

Understanding Daily Cash Back

Daily Cash is a unique feature of the Apple Card that allows users to earn cash back on their purchases. Unlike traditional credit card rewards programs that may require users to wait for monthly statements or annual redemptions, Daily Cash is credited to the user’s Apple Cash account immediately after a purchase. This instant gratification has made the Apple Card particularly appealing to consumers who prefer immediate rewards.

Broader Implications for Apple Card Users

The introduction of Hertz as a 3% Daily Cash partner is part of a broader strategy by Apple to enhance the Apple Card’s appeal in a crowded market. With numerous credit cards offering various rewards and benefits, Apple is keen to differentiate its product by providing unique partnerships and immediate rewards.

Competitive Landscape

The credit card industry is highly competitive, with many financial institutions vying for consumer attention. Traditional banks and newer fintech companies alike offer enticing rewards programs, often featuring cash back, travel points, or other incentives. By adding Hertz to its list of partners, Apple is not only enhancing its rewards program but also positioning itself as a viable option for consumers who prioritize travel and mobility.

Consumer Reactions

Initial reactions from Apple Card users have been largely positive. Many users appreciate the added value of earning 3% Daily Cash on car rentals, especially those who travel frequently for business or leisure. The combination of cash back, lower rates, and emergency services is seen as a compelling reason to choose Hertz over competitors.

Additional Benefits of the Apple Card

Beyond the new partnership with Hertz, the Apple Card offers a range of benefits that make it an attractive option for consumers. These include:

- No Annual Fees: The Apple Card does not charge an annual fee, making it accessible for a wide range of consumers.

- Interest Rate Transparency: Users can easily view their interest rates and understand how their payments are applied, promoting responsible credit use.

- Integration with Apple Pay: The seamless integration with Apple Pay allows users to make purchases quickly and securely using their iPhones or Apple Watches.

- Financial Management Tools: The Apple Card app provides users with tools to track spending, categorize purchases, and manage payments effectively.

Future Prospects for Apple Card

The addition of Hertz as a partner is likely just one of many enhancements Apple has planned for the Apple Card. As the company continues to innovate and expand its financial services, users can expect further partnerships and benefits that align with their lifestyles and spending habits.

Potential for More Partnerships

Given the competitive nature of the credit card market, it is plausible that Apple will seek additional partnerships with other travel and lifestyle brands. Such collaborations could provide users with even more opportunities to earn cash back on a variety of purchases, from hotels to dining experiences. This strategy could not only enhance user engagement but also solidify Apple’s position in the financial services sector.

Impact on Customer Loyalty

By continually enhancing the Apple Card’s offerings, Apple is likely to foster greater customer loyalty among its user base. As consumers become more accustomed to the benefits of the Apple Card, they may be less inclined to switch to competing credit cards, thus creating a more stable revenue stream for Apple’s financial services division.

Conclusion

The introduction of Hertz as a new 3% Daily Cash partner is a significant development for Apple Card users, offering enhanced rewards and additional perks. As Apple continues to innovate within the financial services space, users can expect to see more partnerships and benefits that cater to their needs. The competitive landscape of credit cards demands constant evolution, and Apple appears poised to meet this challenge head-on.

Source: Original report

Was this helpful?

Last Modified: November 5, 2025 at 10:37 am

2 views