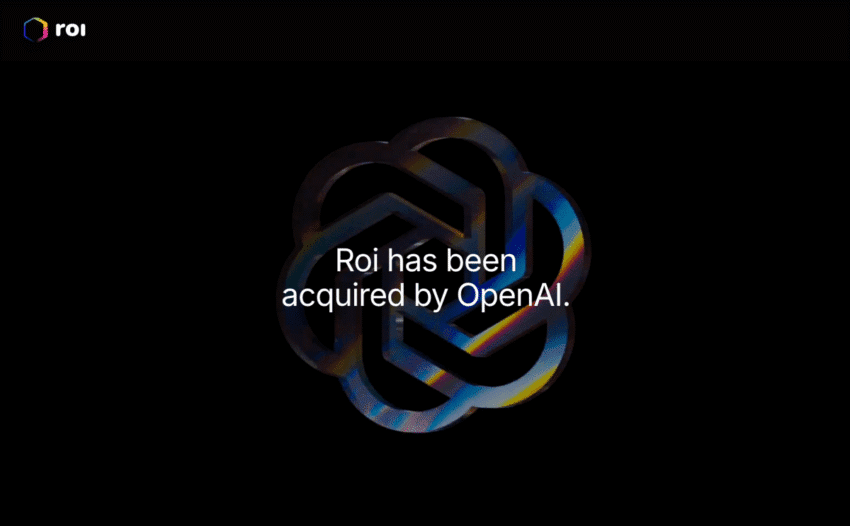

with its latest acqui-hire openai is doubling OpenAI has announced its latest strategic move in the artificial intelligence landscape by acquiring the CEO of Roi, an AI-driven financial companion service, signaling a significant shift towards enhancing personalized consumer applications.

with its latest acqui-hire openai is doubling

Background on OpenAI’s Strategic Direction

OpenAI, known for its groundbreaking advancements in AI technologies, has consistently aimed to integrate artificial intelligence into various aspects of daily life. The organization has been at the forefront of developing tools that not only enhance productivity but also offer personalized experiences to users. This latest acqui-hire is part of a broader strategy to deepen its engagement with consumer applications, particularly in the financial sector.

The decision to acquire talent from Roi aligns with OpenAI’s mission to create AI systems that can understand and respond to individual user needs. By integrating Roi’s expertise, OpenAI aims to refine its offerings, making them more relevant and tailored to the consumer market.

Details of the Acquisition

Roi, a startup that has gained attention for its AI financial companion, has decided to sunset its services as part of this transition. The CEO of Roi, along with other key personnel, will join OpenAI, bringing their specialized knowledge in AI-driven financial solutions. This move is expected to bolster OpenAI’s capabilities in developing consumer-facing applications that can provide personalized financial advice and insights.

The Role of Roi in the AI Landscape

Founded with the goal of making financial advice accessible through AI, Roi has carved out a niche in the fintech sector. The platform utilized machine learning algorithms to analyze users’ financial situations and offer tailored recommendations. By leveraging data analytics, Roi aimed to empower individuals to make informed financial decisions, thereby democratizing access to financial expertise.

As the demand for personalized financial services continues to grow, Roi’s approach resonated with consumers seeking more than just generic advice. The integration of Roi’s technology and talent into OpenAI is expected to enhance the latter’s ability to deliver nuanced financial insights, potentially transforming how users interact with their finances.

Implications for OpenAI’s Consumer Strategy

OpenAI’s decision to acquire Roi’s leadership reflects a calculated effort to strengthen its position in the consumer AI market. The move comes at a time when personalized services are becoming increasingly important to users. With the rise of digital banking and financial management apps, consumers are looking for tools that not only assist with transactions but also provide insightful guidance tailored to their unique financial situations.

By incorporating Roi’s technology and expertise, OpenAI is likely to enhance its existing offerings, such as ChatGPT, making them more capable of delivering personalized financial advice. This could lead to a more engaging user experience, as consumers will benefit from AI that understands their financial goals and challenges.

Market Reactions and Stakeholder Perspectives

The acquisition has garnered attention from various stakeholders in the tech and finance sectors. Analysts have noted that this move could position OpenAI as a formidable player in the fintech space, especially as traditional financial institutions face increasing competition from tech-driven solutions.

Investors have responded positively to the news, recognizing the potential for OpenAI to capture a larger share of the consumer market. The integration of advanced AI capabilities into financial services could lead to innovative products that meet the evolving needs of consumers.

Moreover, existing players in the fintech industry may need to reassess their strategies in light of OpenAI’s enhanced capabilities. The entry of a major AI player into the financial advisory space could disrupt traditional models, prompting established firms to innovate or risk losing market share.

Challenges Ahead

While the acquisition presents numerous opportunities, it also comes with challenges. Integrating new talent and technology into an existing framework can be complex, requiring careful management to ensure a seamless transition. OpenAI will need to navigate potential cultural differences between its existing teams and the new hires from Roi.

Furthermore, the regulatory landscape surrounding financial services is intricate and varies significantly across regions. OpenAI will need to ensure compliance with financial regulations as it develops new products. This includes adhering to data privacy laws and ensuring that AI-driven financial advice is both accurate and responsible.

Consumer Expectations and Trust

As OpenAI ventures into personalized financial services, consumer trust will be paramount. Users need to feel confident that the AI systems they engage with are secure, reliable, and capable of providing sound financial advice. OpenAI will have to prioritize transparency in its algorithms and decision-making processes to build and maintain this trust.

Moreover, educating consumers about the capabilities and limitations of AI in financial contexts will be essential. Users must understand that while AI can provide valuable insights, it should not replace human judgment entirely. OpenAI’s approach to consumer education will play a critical role in fostering a positive relationship between users and AI-driven financial tools.

The Future of Personalized Consumer AI

The acquisition of Roi’s leadership marks a significant step in OpenAI’s journey towards enhancing personalized consumer AI. As the demand for tailored solutions continues to rise, the integration of advanced AI technologies into everyday applications will likely become more prevalent.

OpenAI’s focus on personalized financial services could set a precedent for other tech companies looking to enter the consumer finance space. The success of this initiative may inspire further innovation, leading to the development of new tools that empower consumers to take control of their financial futures.

Potential Collaborations and Innovations

Looking ahead, OpenAI may explore collaborations with financial institutions to leverage their expertise and resources. Partnerships with banks and fintech companies could enhance the development of AI-driven financial products, combining the strengths of both sectors.

Additionally, OpenAI’s commitment to ethical AI practices will be crucial as it navigates the complexities of the financial landscape. By prioritizing responsible AI development, OpenAI can set a standard for the industry, ensuring that personalized financial services are not only effective but also equitable and accessible to all consumers.

Conclusion

OpenAI’s acquisition of Roi’s CEO and the subsequent sunset of Roi’s services represent a strategic pivot towards personalized consumer AI, particularly in the financial sector. As OpenAI integrates this new talent and technology, the potential for innovative financial solutions grows. However, the organization must also address the challenges of integration, regulatory compliance, and consumer trust. The future of personalized AI in finance looks promising, and OpenAI is poised to play a significant role in shaping this evolving landscape.

Source: Original report

Was this helpful?

Last Modified: October 4, 2025 at 4:38 am

1 views