where top vcs are betting next index Leading venture capitalists are revealing their investment priorities for 2026 at the upcoming TechCrunch Disrupt 2025 event in San Francisco.

where top vcs are betting next index

Insights from Industry Leaders

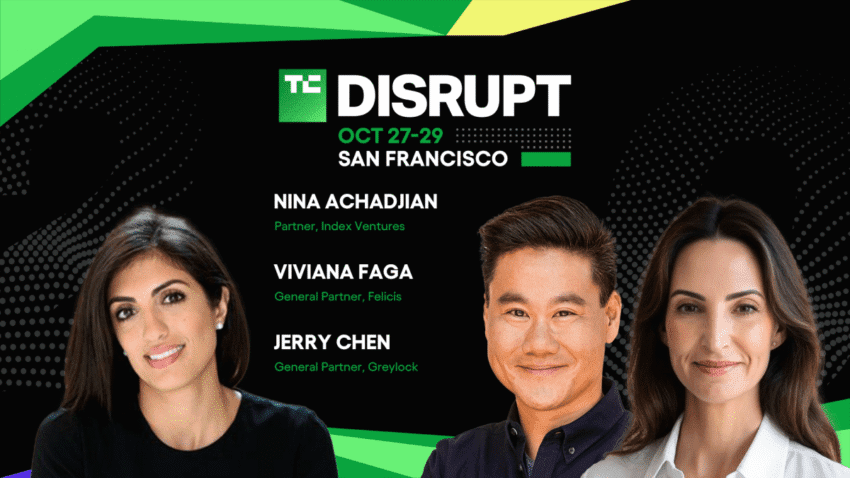

At TechCrunch Disrupt 2025, taking place from October 27 to 29, prominent venture capitalists from Index Ventures, Greylock, and Felicis will share their insights on where they believe the next wave of innovation will occur. Nina Achadjian of Index Ventures, Jerry Chen from Greylock, and Viviana Faga of Felicis are set to take the stage, providing invaluable perspectives on emerging trends and sectors ripe for investment.

The Importance of VC Insights

Venture capitalists play a crucial role in shaping the technology landscape. Their investment decisions not only influence the growth trajectories of startups but also impact broader industry trends. By understanding where these top investors are focusing their resources, entrepreneurs, industry analysts, and other stakeholders can gain a clearer picture of the future of technology and innovation.

Event Overview

TechCrunch Disrupt is a premier event in the tech industry calendar, attracting entrepreneurs, investors, and thought leaders from around the globe. This year’s event promises to be particularly insightful, as the featured VCs will discuss their strategies and priorities for the coming year. The Builders Stage will serve as a platform for these discussions, allowing attendees to engage directly with the speakers and gain insights into their investment philosophies.

Spotlight on the VCs

Nina Achadjian – Index Ventures

Nina Achadjian has established herself as a prominent figure in the venture capital landscape, particularly known for her focus on early-stage investments in technology startups. At Index Ventures, she has been involved in funding several successful companies, helping them scale and navigate the complexities of growth.

Achadjian’s investment strategy often emphasizes the importance of strong founding teams and innovative business models. She is likely to discuss how Index Ventures plans to identify and support the next generation of entrepreneurs in 2026. Her insights will be particularly valuable for startups looking to attract venture capital funding, as she will share what she believes are the key attributes that make a startup appealing to investors.

Jerry Chen – Greylock Partners

Jerry Chen, a partner at Greylock, has a reputation for his deep understanding of consumer technology and enterprise software. His experience in the tech industry, combined with his keen eye for emerging trends, positions him as a thought leader in venture capital.

At TechCrunch Disrupt, Chen is expected to delve into the sectors he believes will see significant growth in 2026. His focus may include artificial intelligence, cloud computing, and other transformative technologies that are reshaping industries. Chen’s perspective will be crucial for entrepreneurs seeking to align their business models with the evolving demands of the market.

Viviana Faga – Felicis Ventures

Viviana Faga, a partner at Felicis Ventures, brings a unique approach to venture capital, often focusing on companies that are not only innovative but also socially responsible. Her commitment to investing in startups that prioritize sustainability and ethical practices sets her apart in the industry.

Faga’s contributions to the discussion at TechCrunch Disrupt will likely highlight the growing importance of environmental, social, and governance (ESG) factors in investment decisions. As more investors recognize the value of sustainable practices, Faga’s insights will be essential for entrepreneurs looking to position their companies favorably in a competitive landscape.

Key Themes for 2026

While the specific sectors and companies that will be discussed at the event remain to be seen, several key themes are likely to emerge based on current trends in the venture capital ecosystem.

Technological Innovation

The rapid pace of technological advancement continues to be a driving force behind venture capital investments. Areas such as artificial intelligence, machine learning, and blockchain technology are expected to attract significant attention from investors in 2026. Startups that can leverage these technologies to create innovative solutions will likely find themselves in a favorable position.

Sustainability and Social Impact

As awareness of climate change and social issues grows, investors are increasingly looking for opportunities that align with their values. Startups that prioritize sustainability and social impact are likely to capture the interest of venture capitalists like Viviana Faga. This trend reflects a broader shift in the investment landscape, where ethical considerations are becoming as important as financial returns.

Health Tech and Biotech

The COVID-19 pandemic has accelerated advancements in health technology and biotechnology, making these sectors a focal point for investors. Companies that are innovating in telemedicine, personalized medicine, and health data analytics are expected to attract significant funding in the coming years. The insights from the VCs at TechCrunch Disrupt will shed light on which specific areas within health tech and biotech are poised for growth.

Implications for Entrepreneurs

For entrepreneurs attending TechCrunch Disrupt, the discussions led by Achadjian, Chen, and Faga will provide critical insights into the current investment landscape. Understanding the priorities of these top VCs can help startups tailor their pitches and business models to align with investor expectations.

Moreover, the event offers a unique networking opportunity for entrepreneurs to connect with potential investors, industry peers, and mentors. Engaging with leading venture capitalists can provide invaluable feedback and guidance, helping startups refine their strategies and increase their chances of securing funding.

Stakeholder Reactions

The anticipation surrounding TechCrunch Disrupt 2025 is palpable among various stakeholders in the tech ecosystem. Entrepreneurs are eager to hear directly from the VCs about their investment priorities, while investors are keen to identify emerging trends and potential opportunities.

Industry analysts are also closely monitoring the event, as the insights shared by these prominent VCs will likely influence market predictions and investment strategies in the coming year. The discussions at TechCrunch Disrupt will serve as a barometer for the health and direction of the venture capital landscape.

Conclusion

The upcoming TechCrunch Disrupt 2025 event promises to be a pivotal moment for entrepreneurs and investors alike. With insights from leading venture capitalists like Nina Achadjian, Jerry Chen, and Viviana Faga, attendees will gain a deeper understanding of where the smart money is headed in 2026. As the tech landscape continues to evolve, the discussions at this event will provide essential guidance for navigating the complexities of venture capital investment.

Source: Original report

Was this helpful?

Last Modified: September 9, 2025 at 7:44 pm

0 views