sequoia-backed fintech aspora will let indian diaspora Aspora, a fintech startup backed by Sequoia Capital, is set to revolutionize how the Indian diaspora manages their financial obligations back home by allowing them to pay bills directly from abroad.

sequoia-backed fintech aspora will let indian diaspora

Understanding the Need for Aspora

The Indian diaspora, which comprises millions of individuals living and working outside India, often faces significant challenges when it comes to managing their financial responsibilities back home. Traditionally, these individuals have had to navigate a cumbersome process to pay bills, which can include utilities, loans, and other essential services. The existing methods have proven to be inefficient and costly, prompting the need for a more streamlined solution.

Current Challenges Faced by the Indian Diaspora

Until now, individuals in the Indian diaspora had a few options for managing their bills:

- Transferring Money to Indian Accounts: Users could transfer funds to their Indian bank accounts, which often involved high fees and unfavorable exchange rates. This process could take several days, leaving bills unpaid and services at risk of disconnection.

- Relying on Friends or Family: Many opted to ask relatives or friends in India to handle their bills. This method, while sometimes effective, relied heavily on trust and could lead to misunderstandings or errors.

- Using Foreign Cards: Some users attempted to pay bills directly using their foreign credit or debit cards. However, this often resulted in high transaction fees and frequent payment failures, causing frustration and delays.

These challenges not only created financial stress for the diaspora but also hindered their ability to maintain a connection with their home country. Aspora aims to address these issues head-on.

Aspora’s Innovative Solution

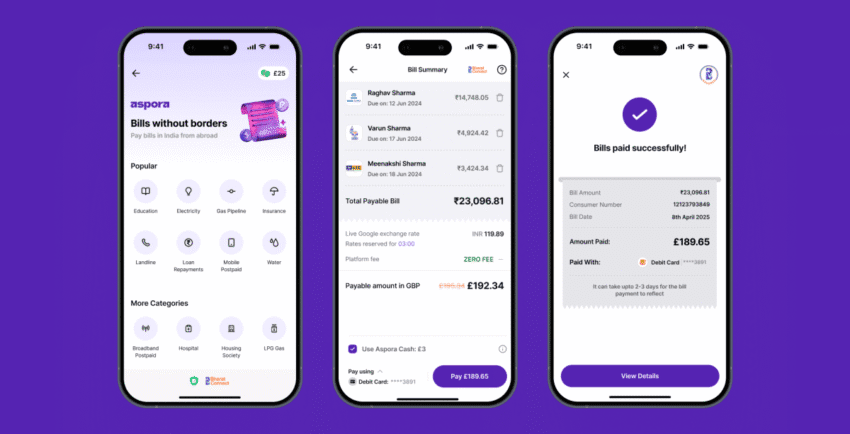

Aspora’s platform is designed to simplify the bill payment process for the Indian diaspora. By allowing users to pay their bills directly from abroad, the startup eliminates the need for complicated transfers or reliance on third parties. This innovation is expected to enhance the financial experience for millions of Indians living overseas.

Key Features of Aspora

Aspora offers several features that set it apart from traditional payment methods:

- Direct Bill Payments: Users can pay their bills directly from their foreign bank accounts, eliminating the need for intermediaries. This feature not only saves time but also reduces the risk of payment failures.

- Competitive Exchange Rates: Aspora provides competitive exchange rates, ensuring that users get more value for their money when converting currencies.

- User-Friendly Interface: The platform is designed with ease of use in mind, allowing users to navigate the payment process effortlessly.

- Real-Time Notifications: Users receive real-time updates on their transactions, providing transparency and peace of mind.

These features make Aspora a compelling option for the Indian diaspora, who are often looking for efficient and cost-effective ways to manage their finances from abroad.

Implications for the Indian Diaspora

The introduction of Aspora could have far-reaching implications for the Indian diaspora. By simplifying the bill payment process, the platform not only alleviates financial stress but also fosters a stronger connection between individuals and their home country.

Strengthening Ties with Home

For many in the diaspora, maintaining a connection with India is essential. Financial obligations often serve as a reminder of their roots, and being able to manage these responsibilities directly can enhance their sense of belonging. Aspora’s platform allows users to engage more actively with their home country, reinforcing their ties to family, culture, and community.

Economic Impact on India

The ability for the diaspora to pay bills directly could also have a positive economic impact on India. Timely payments for utilities and services can help stabilize local economies, ensuring that businesses and service providers receive the funds they need to operate effectively. This, in turn, can contribute to overall economic growth.

Potential for Expansion

As Aspora gains traction among the Indian diaspora, there is potential for the platform to expand its offerings. Future developments could include:

- Investment Opportunities: Aspora could explore options for users to invest in Indian startups or real estate, further enhancing their financial engagement with the country.

- Insurance Products: The platform could introduce insurance products tailored to the needs of the diaspora, providing additional financial security.

- Financial Education Resources: Aspora could offer educational resources to help users better understand financial management and investment opportunities in India.

Such expansions could further solidify Aspora’s position as a comprehensive financial solution for the Indian diaspora.

Stakeholder Reactions

The launch of Aspora has garnered attention from various stakeholders, including investors, financial analysts, and members of the Indian diaspora. Many view the platform as a timely solution to long-standing challenges faced by individuals living abroad.

Investor Confidence

Sequoia Capital’s backing of Aspora signals strong investor confidence in the startup’s potential. The venture capital firm is known for its strategic investments in innovative technology companies, and its support could pave the way for further funding opportunities. Investors are likely to monitor Aspora’s growth closely, especially as it navigates the competitive fintech landscape.

Community Feedback

Members of the Indian diaspora have expressed enthusiasm about Aspora’s offerings. Many have shared their frustrations with existing payment methods and are eager for a solution that simplifies the process. Feedback from early users has been largely positive, highlighting the platform’s ease of use and efficiency.

Regulatory Considerations

As with any fintech startup, Aspora will need to navigate regulatory considerations in both India and the countries where its users reside. Compliance with financial regulations is crucial for building trust and ensuring the platform’s long-term success. Stakeholders will be watching closely to see how Aspora addresses these challenges.

Conclusion

Aspora represents a significant advancement in the fintech landscape for the Indian diaspora. By addressing the challenges of bill payments from abroad, the startup not only simplifies financial management but also strengthens the ties between individuals and their home country. As the platform continues to evolve, it has the potential to expand its offerings and further enhance the financial experience for millions of Indians living overseas.

Source: Original report

Was this helpful?

Last Modified: November 18, 2025 at 9:38 am

1 views