powered by india s small businesses uk UK fintech Tide has achieved unicorn status, bolstered significantly by its operations in India, where it serves a substantial number of small businesses.

powered by india s small businesses uk

Overview of Tide’s Growth and Expansion

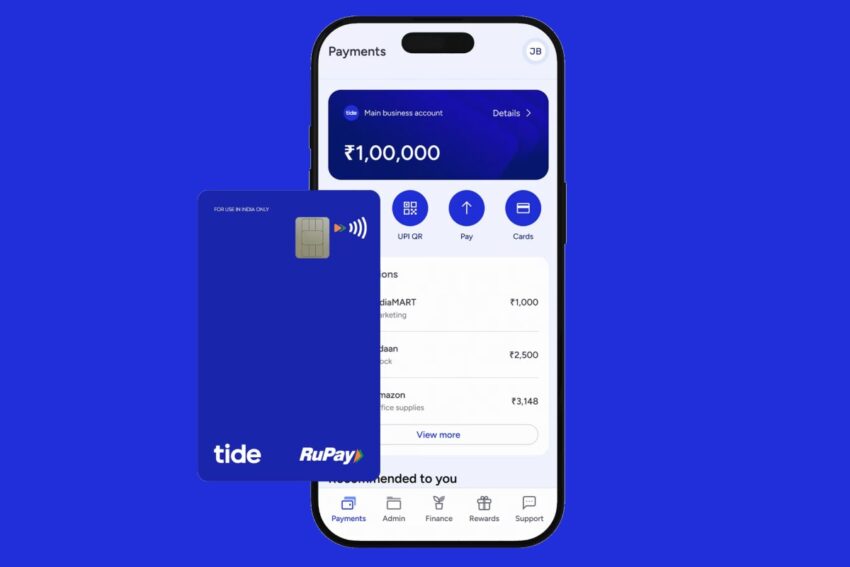

Tide, a financial technology company based in the United Kingdom, has rapidly expanded its services to cater to micro and small enterprises around the globe. As of now, the company boasts a client base of over 1.6 million businesses, with more than half of these clients located in India. This remarkable growth trajectory has attracted significant investment, culminating in Tide’s recent valuation exceeding $1 billion, officially marking it as a unicorn.

The Role of Small Businesses in Tide’s Success

Small businesses are often regarded as the backbone of economies, and Tide has strategically positioned itself to support this vital sector. The fintech firm offers a suite of financial services tailored to the unique needs of micro and small enterprises, including business accounts, expense management, and invoicing tools. By focusing on this demographic, Tide has not only filled a gap in the market but has also established a loyal customer base.

In India, where the small business ecosystem is burgeoning, Tide’s services have resonated well. The country is home to millions of micro and small enterprises, many of which struggle with traditional banking systems that often overlook their specific needs. Tide’s user-friendly platform and accessible financial solutions have made it an attractive option for these businesses, facilitating easier access to banking services that are crucial for their growth.

Investment and Valuation Milestones

The recent investment from TPG Capital, a global private equity firm, has been a pivotal moment for Tide. This funding round not only solidifies Tide’s unicorn status but also provides the necessary capital to further enhance its offerings and expand its reach. TPG’s involvement signals confidence in Tide’s business model and its potential for future growth, particularly in emerging markets like India.

Understanding the Unicorn Status

Achieving unicorn status is a significant milestone for any startup, representing a valuation of over $1 billion. This status is often seen as a marker of success and viability in the competitive fintech landscape. For Tide, this achievement underscores its rapid growth and the increasing demand for its services among small businesses.

The influx of capital from TPG will enable Tide to invest in technology upgrades, marketing initiatives, and possibly even geographical expansion. Such investments are crucial for maintaining a competitive edge in the fintech sector, which is characterized by rapid innovation and evolving customer expectations.

The Indian Market: A Key Driver

India’s small business sector is a critical driver of the country’s economic growth, contributing significantly to employment and GDP. The government has also recognized the importance of this sector, implementing various initiatives to support small businesses, including financial assistance and regulatory reforms. Tide’s success in India can be attributed to its ability to align with these national priorities.

Challenges Faced by Small Businesses in India

Despite the opportunities, small businesses in India face numerous challenges that can hinder their growth. These include limited access to credit, bureaucratic hurdles, and a lack of financial literacy among entrepreneurs. Traditional banks often impose stringent requirements for loans, leaving many small business owners without the necessary funding to expand their operations.

Tide addresses these challenges by offering a more inclusive approach to banking. Its platform simplifies the application process for financial products, making it easier for small business owners to access the funds they need. Additionally, Tide provides educational resources to help entrepreneurs improve their financial literacy, empowering them to make informed decisions about their businesses.

Stakeholder Reactions and Market Implications

The announcement of Tide’s unicorn status has elicited positive reactions from various stakeholders, including investors, small business owners, and industry analysts. Investors view Tide’s growth as a promising indicator of the fintech sector’s potential, particularly in emerging markets like India. Small business owners have expressed enthusiasm for the tailored services that Tide offers, which they believe can significantly enhance their operational efficiency.

Industry Analysts’ Perspectives

Industry analysts have noted that Tide’s success could inspire other fintech companies to focus on underserved markets. The ability to cater to micro and small enterprises presents a lucrative opportunity, as these businesses often require specialized financial services that traditional banks are unwilling or unable to provide. Analysts predict that more fintech firms will follow Tide’s lead, creating a more competitive landscape that ultimately benefits small business owners.

Future Prospects for Tide

Looking ahead, Tide’s future appears promising. With the backing of TPG and a strong foothold in India, the company is well-positioned to capitalize on the growing demand for fintech solutions among small businesses. The ongoing digital transformation in India, accelerated by the COVID-19 pandemic, has further increased the need for accessible and efficient financial services.

Potential for Geographic Expansion

While Tide has made significant inroads in India, there are opportunities for expansion into other emerging markets. Countries in Southeast Asia, Africa, and Latin America also have burgeoning small business sectors that could benefit from Tide’s offerings. By leveraging its technology and expertise, Tide could replicate its success in these regions, further solidifying its position as a leading fintech provider.

Conclusion

Tide’s ascent to unicorn status is a testament to its innovative approach to serving small businesses, particularly in India. By addressing the unique challenges faced by micro and small enterprises, Tide has carved out a niche in the competitive fintech landscape. With substantial backing from TPG and a commitment to enhancing its services, Tide is poised for continued growth and success in the years to come.

Source: Original report

Was this helpful?

Last Modified: September 22, 2025 at 11:36 am

0 views