nvidia s ai empire a look at Nvidia has significantly expanded its influence in the artificial intelligence sector by investing in over 100 AI startups in the past two years.

nvidia s ai empire a look at

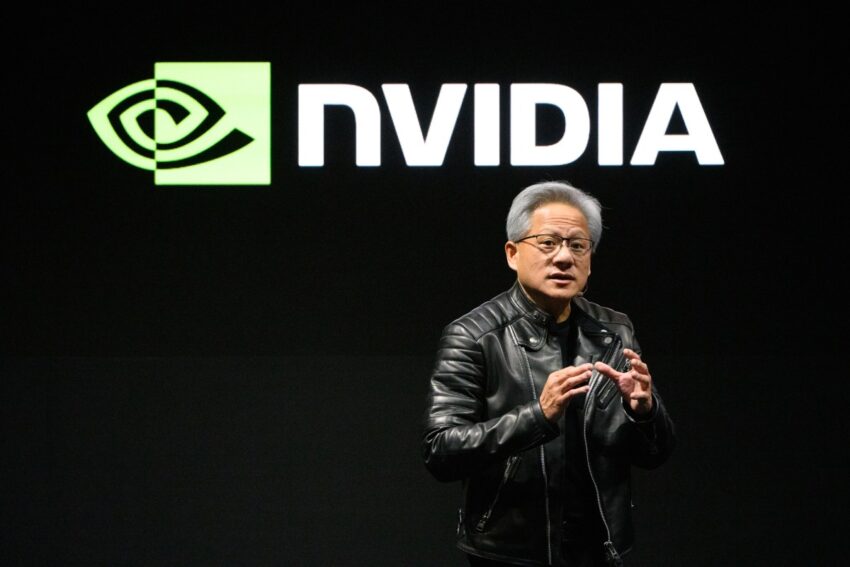

Nvidia’s Strategic Shift Towards AI

As a leader in the semiconductor industry, Nvidia has made a remarkable pivot towards artificial intelligence (AI) technologies. This shift is not merely a response to market trends; it reflects a calculated strategy to leverage its existing strengths in graphics processing units (GPUs) and machine learning. With the growing demand for AI capabilities across various sectors, Nvidia has positioned itself as a key player in this rapidly evolving landscape.

In recent years, Nvidia’s financial performance has soared, largely due to the increasing reliance on AI technologies. The company’s revenue has seen exponential growth, driven by its advanced GPU offerings that power AI applications. This financial windfall has enabled Nvidia to invest heavily in startups that are innovating in the AI space, further solidifying its dominance in the industry.

Investment Strategy and Focus Areas

Nvidia’s investment strategy is characterized by a focus on startups that are at the forefront of AI innovation. The company has targeted various sectors, including healthcare, autonomous vehicles, robotics, and cloud computing. By investing in these areas, Nvidia aims to enhance its product offerings and expand its market reach.

Healthcare Innovations

One of the most promising sectors for AI applications is healthcare. Nvidia has invested in several startups that are developing AI-driven solutions for medical diagnostics, drug discovery, and personalized medicine. These investments not only align with Nvidia’s technological capabilities but also address critical challenges in the healthcare industry.

For instance, startups that utilize AI for imaging analysis can significantly improve diagnostic accuracy, leading to better patient outcomes. Nvidia’s GPUs are particularly well-suited for processing large datasets, making them ideal for training complex AI models in healthcare.

Autonomous Vehicles

The autonomous vehicle market represents another key area of interest for Nvidia. The company has made substantial investments in startups that are working on self-driving technology, which relies heavily on AI algorithms for perception, decision-making, and control. Nvidia’s Drive platform is already a cornerstone in the development of autonomous vehicles, and its investments in related startups further enhance its capabilities in this domain.

By collaborating with these startups, Nvidia not only gains access to innovative technologies but also positions itself as a leader in the future of transportation. The integration of AI in vehicles is expected to revolutionize the automotive industry, and Nvidia aims to be at the forefront of this transformation.

Robotics and Automation

Robotics is another sector where Nvidia has made significant investments. The rise of automation in various industries has created a demand for advanced robotic systems that can perform complex tasks. Nvidia’s expertise in AI and machine learning makes it a natural fit for this market.

Startups focused on robotic process automation (RPA) and AI-driven robotics are receiving attention from Nvidia, as these technologies can enhance productivity and efficiency across different sectors. By investing in these startups, Nvidia is not only expanding its portfolio but also contributing to the advancement of intelligent automation solutions.

Cloud Computing and AI Infrastructure

The cloud computing sector is crucial for the deployment of AI technologies. Nvidia has recognized this and has invested in startups that provide cloud-based AI services and infrastructure. These investments are aimed at enhancing the scalability and accessibility of AI solutions for businesses of all sizes.

As more organizations migrate to the cloud, the demand for AI capabilities is expected to grow. Nvidia’s investments in cloud-based AI startups position the company to capitalize on this trend, ensuring that its technologies remain integral to the evolving landscape of AI deployment.

Notable Investments and Partnerships

Nvidia’s investment portfolio includes several notable startups that have garnered attention for their innovative approaches to AI. These investments not only reflect Nvidia’s strategic priorities but also highlight the potential of these startups to disrupt their respective industries.

Leading AI Startups

- HealthAI: This startup focuses on using AI for predictive analytics in healthcare, enabling early diagnosis and personalized treatment plans.

- AutoDrive: A leader in autonomous vehicle technology, AutoDrive is developing advanced AI algorithms for real-time decision-making in self-driving cars.

- RoboWorks: Specializing in robotic automation, RoboWorks is creating AI-driven robots that can perform a variety of tasks in manufacturing and logistics.

- CloudAI: This startup provides cloud-based AI solutions, making it easier for businesses to integrate AI capabilities into their operations.

These startups exemplify the diversity of Nvidia’s investment strategy, showcasing its commitment to fostering innovation across multiple sectors. By supporting these companies, Nvidia not only enhances its technological capabilities but also contributes to the broader AI ecosystem.

Implications for the AI Landscape

Nvidia’s aggressive investment strategy has significant implications for the AI landscape. As the company continues to support innovative startups, it is likely to shape the direction of AI development in various sectors. This influence can lead to accelerated advancements in technology, as well as increased competition among startups seeking to differentiate themselves in a crowded market.

Moreover, Nvidia’s investments may encourage other tech giants to follow suit, leading to a surge in funding for AI startups. This influx of capital can drive further innovation and research, ultimately benefiting consumers and businesses alike.

Stakeholder Reactions

The reactions from stakeholders within the tech industry have been largely positive. Investors and analysts view Nvidia’s investments as a strategic move that positions the company for long-term success in the AI market. Many believe that Nvidia’s expertise in GPUs and AI will enable it to effectively support the growth of its portfolio companies.

Startups that receive funding from Nvidia often express enthusiasm about the partnership, citing the company’s resources and industry knowledge as invaluable assets. These collaborations can provide startups with the necessary support to scale their operations and bring innovative solutions to market more quickly.

Future Outlook

Looking ahead, Nvidia’s commitment to investing in AI startups is expected to continue. As the demand for AI technologies grows, the company is likely to seek out new opportunities for investment, particularly in emerging sectors that leverage AI for transformative solutions.

Furthermore, Nvidia’s ongoing research and development efforts will likely complement its investment strategy, allowing the company to stay ahead of technological trends and maintain its competitive edge in the AI landscape. The interplay between Nvidia’s core business and its startup investments will be crucial in shaping the future of AI technologies.

Conclusion

Nvidia’s aggressive investment strategy in AI startups reflects a broader trend within the tech industry, where established companies are increasingly looking to foster innovation through strategic partnerships. By investing in over 100 AI startups in the past two years, Nvidia has positioned itself as a leader in the AI space, with a diverse portfolio that spans healthcare, autonomous vehicles, robotics, and cloud computing.

As the AI landscape continues to evolve, Nvidia’s influence is likely to grow, shaping the future of technology and driving advancements that will benefit various sectors. The company’s investments not only enhance its own capabilities but also contribute to the broader ecosystem of AI innovation, paving the way for a more intelligent and automated future.

Source: Original report

Was this helpful?

Last Modified: October 13, 2025 at 3:37 am

1 views