new image-generating ais are being used for Recent advancements in artificial intelligence are enabling employees to exploit the technology for fraudulent purposes, particularly in the realm of expense reporting.

new image-generating ais are being used for

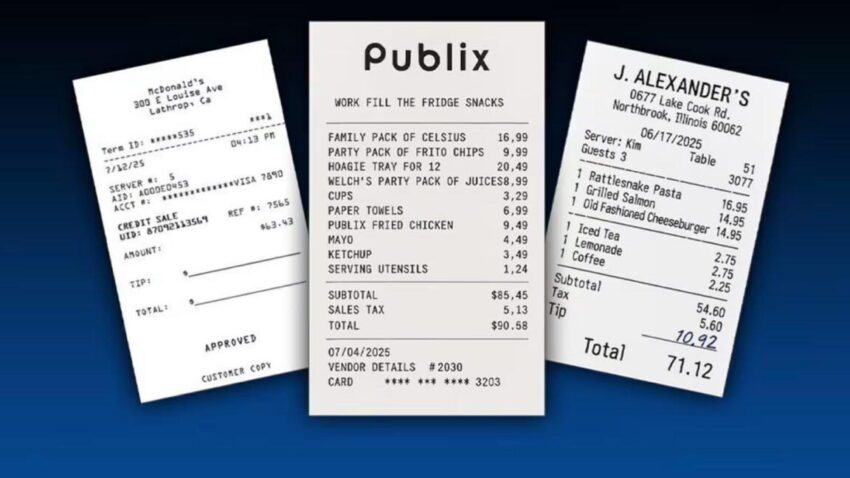

Rise of AI-Generated Receipts

As businesses increasingly adopt digital solutions for expense management, the emergence of sophisticated image-generating models from leading AI companies like OpenAI and Google has led to a troubling trend: the creation of fake expense receipts. These AI-generated documents are becoming a tool for employees looking to submit fraudulent expense reports, posing significant challenges for organizations striving to maintain financial integrity.

Understanding the Technology

The technology behind AI-generated images has advanced rapidly in recent years. Models such as OpenAI’s DALL-E and Google’s Imagen utilize deep learning algorithms to create highly realistic images from textual descriptions. This capability extends beyond mere artistic creation; it can produce documents that closely mimic legitimate receipts, making it increasingly difficult for companies to distinguish between authentic and fraudulent submissions.

Impact on Expense Management

Expense management software providers are witnessing a marked increase in the submission of AI-generated receipts. According to AppZen, a leading provider in this space, fake AI receipts constituted approximately 14 percent of fraudulent documents submitted in September 2025. This figure is striking, especially when compared to the previous year, which saw no reports of AI-generated receipts being used in fraud cases. The rapid rise in this type of fraud underscores the urgent need for businesses to adapt their verification processes.

Financial Implications

The financial ramifications of this trend are significant. Ramp, a fintech company specializing in expense management, reported that its software flagged over $1 million in fraudulent invoices within just 90 days of its deployment. This alarming statistic highlights the scale of the problem and the potential losses that companies could face if they do not implement robust measures to combat this form of fraud.

Types of Fraudulent Activities

Fraudulent activities related to expense reporting can take various forms, including:

- Submitting fake receipts generated by AI.

- Altering legitimate receipts to inflate expenses.

- Claiming expenses for non-existent services or products.

AI-generated receipts can make it easier for employees to engage in these activities, as the technology allows for the rapid creation of convincing documents that can easily bypass traditional verification methods.

Challenges in Detection

Detecting AI-generated receipts poses unique challenges for organizations. Traditional methods of verification, such as manual checks and pattern recognition, may not suffice against the high quality of AI-generated images. As these technologies evolve, so too must the strategies employed by businesses to identify fraudulent submissions.

Current Detection Methods

Many companies currently rely on a combination of automated and manual verification processes. These may include:

- Cross-referencing receipts with vendor databases.

- Implementing machine learning algorithms to identify anomalies in expense submissions.

- Conducting random audits of employee expense reports.

While these methods can be effective, they may not be enough to combat the sophisticated nature of AI-generated receipts. As the technology continues to improve, companies may need to invest in more advanced detection tools that can specifically target AI-generated content.

Stakeholder Reactions

The emergence of AI-generated receipts has elicited a range of reactions from stakeholders across various sectors. Business leaders, compliance officers, and technology experts are all grappling with the implications of this new form of fraud.

Business Leaders’ Concerns

Many business leaders express concern over the potential for increased financial losses due to AI-generated fraud. The ability to create convincing fake receipts could undermine trust within organizations and lead to a culture of skepticism regarding expense reporting. Some executives are advocating for more stringent policies and enhanced training for employees to raise awareness about the risks associated with AI-generated documents.

Compliance and Legal Implications

Compliance officers are also taking note of the situation. The use of AI-generated receipts raises questions about the legal ramifications of fraudulent expense reporting. Organizations may need to reassess their compliance frameworks to ensure they are equipped to handle the complexities introduced by AI technology. This may involve updating internal policies, enhancing training programs, and potentially facing legal challenges if fraudulent activities lead to significant financial losses.

Technology Experts’ Perspectives

Technology experts emphasize the need for innovation in detection methods. As AI-generated content becomes more prevalent, there is a growing demand for solutions that can effectively identify and flag fraudulent submissions. Some experts suggest that companies should explore the use of blockchain technology to create immutable records of transactions, making it more difficult for fraudulent activities to go unnoticed.

Future Outlook

The future of expense reporting in the age of AI presents both challenges and opportunities. As businesses adapt to the realities of AI-generated fraud, they may also find ways to leverage the technology for their benefit. For instance, AI can be utilized to streamline expense reporting processes, improve accuracy, and enhance overall efficiency.

Adapting to Change

Organizations must remain vigilant and proactive in addressing the risks associated with AI-generated receipts. This may involve:

- Investing in advanced detection technologies.

- Regularly updating policies and procedures to reflect the evolving landscape.

- Providing ongoing training for employees to recognize and report suspicious activity.

By taking these steps, companies can better protect themselves against the financial and reputational risks posed by fraudulent expense reporting.

Conclusion

The rise of AI-generated receipts marks a significant shift in the landscape of expense reporting fraud. As businesses navigate this new terrain, they must remain vigilant and adaptable to protect their financial interests. The implications of this trend extend beyond immediate financial losses; they also touch on issues of trust, compliance, and the ethical use of technology. By investing in robust detection methods and fostering a culture of transparency, organizations can mitigate the risks associated with AI-generated fraud and ensure the integrity of their expense reporting processes.

Source: Original report

Was this helpful?

Last Modified: October 27, 2025 at 8:37 pm

0 views