netflix is buying warner bros for 83 Netflix has announced that it’s struck a deal to acquire Warner Bros. for $82.7 billion.

netflix is buying warner bros for 83

Details of the Acquisition

The acquisition will proceed following Warner Bros.’ planned split from Discovery, which is now anticipated to occur in the third quarter of 2026. This strategic move will enable Netflix to acquire not only the Warner studio but also HBO and HBO Max, along with access to an extensive library of intellectual property (IP) that includes iconic franchises such as Harry Potter, Game of Thrones, and DC Comics.

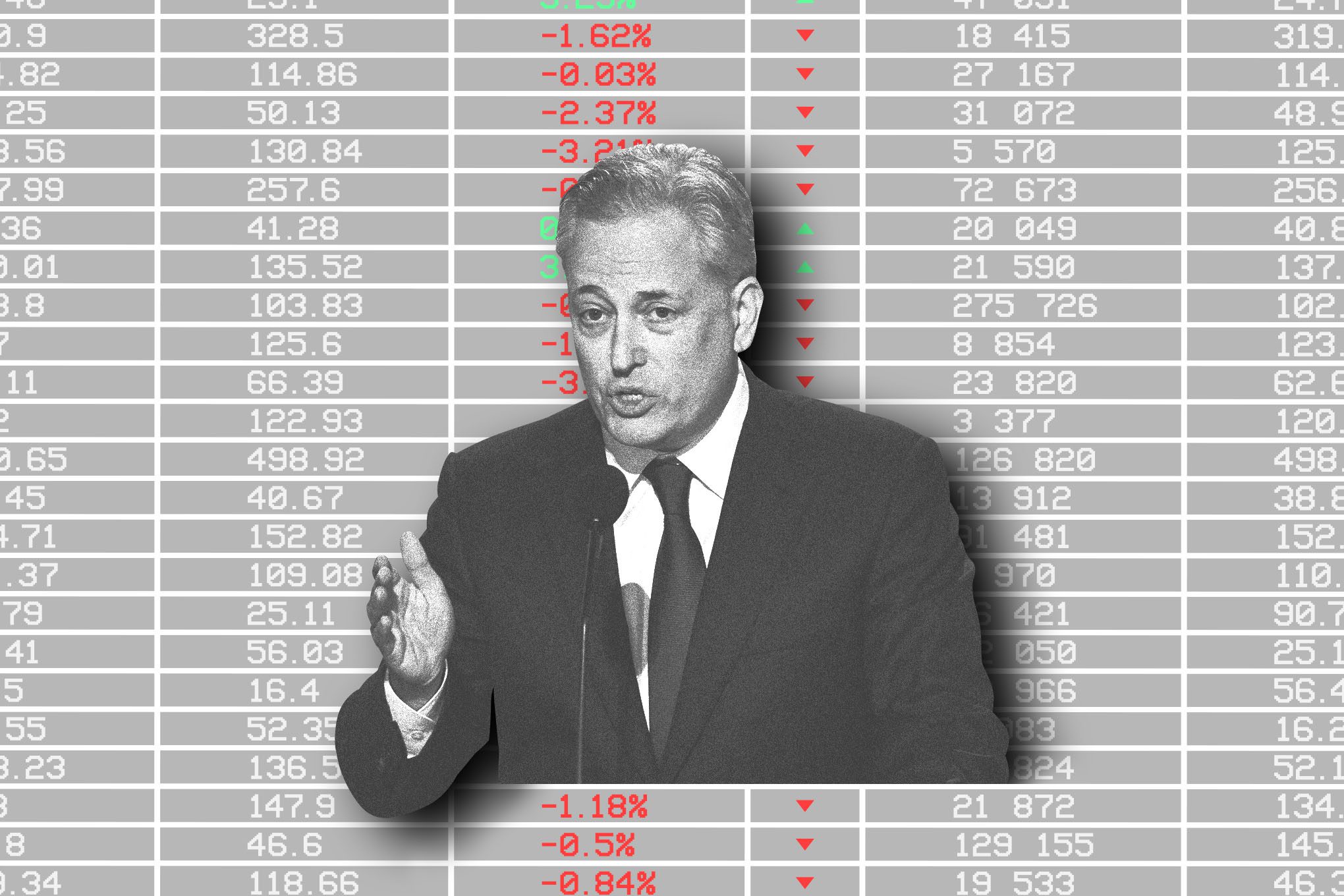

Statements from Leadership

Ted Sarandos, co-CEO of Netflix, expressed enthusiasm about the acquisition, stating, “Our mission has always been to entertain the world. By combining Warner Bros.’ incredible library of shows and movies—from timeless classics like Casablanca and Citizen Kane to modern favorites like Harry Potter and Friends—with our culture-defining titles like Stranger Things, KPop Demon Hunters, and Squid Game, we’ll be able to do that even better.” This statement underscores Netflix’s commitment to enhancing its content offerings and expanding its audience reach.

Competitive Landscape

Reports indicate that Netflix emerged victorious in a competitive bidding war for Warner Bros.’ studio and streaming assets. This includes HBO, DC Comics, and the video game publisher Warner Bros. Games. The final deal was reportedly finalized in a relatively short timeframe, reflecting Netflix’s aggressive strategy in the streaming market.

Netflix’s bid of $82.7 billion surpassed offers from other major players in the industry, including Comcast and Paramount. Paramount, fresh from its merger with Skydance, had initially shown interest in acquiring both halves of Warner Bros. Discovery, but Netflix’s focus was solely on the studio side. Early interest had also been noted from tech giants like Amazon and Apple, but they ultimately did not proceed with bids.

Strategic Implications

Netflix’s acquisition of Warner Bros. is poised to reshape the competitive dynamics of the streaming industry. By integrating Warner Bros.’ extensive library and production capabilities, Netflix will enhance its content portfolio significantly. The acquisition also allows Netflix to leverage Warner Bros.’ established franchises, which have proven to be immensely popular among audiences worldwide.

Moreover, the deal is expected to bolster Netflix’s position in the theatrical space, an area it has historically approached with caution. The acquisition will grant Netflix access to Warner Bros.’ theatrical releases, allowing it to diversify its content distribution strategy. This could lead to a more robust presence in cinemas, potentially increasing revenue streams beyond its subscription model.

Operational Continuity

In its announcement, Netflix indicated that it has no immediate plans for drastic changes at Warner Bros. The company described HBO and HBO Max as a “compelling, complementary offering” alongside its existing streaming service. Netflix has committed to maintaining the studio’s current operations, including theatrical releases for films, which suggests a strategy focused on operational continuity rather than upheaval.

Regulatory Considerations

As with any major acquisition, regulatory approval will be a critical factor in the completion of this deal. Netflix reportedly pledged a $5 billion breakup fee in the event that regulators block the buyout. This move underscores the potential challenges Netflix may face in navigating regulatory scrutiny, particularly from the Department of Justice, which has historically been vigilant about antitrust issues in the media and entertainment sectors.

Concerns regarding market concentration and the implications of consolidating such significant assets under one umbrella are likely to arise. The acquisition could prompt scrutiny regarding competition, particularly in the streaming market, where Netflix is already a dominant player. The outcome of this regulatory review will be pivotal in determining the future landscape of the entertainment industry.

Market Reactions

The announcement of the acquisition has elicited a range of reactions from industry stakeholders. Analysts have expressed cautious optimism about the potential synergies between Netflix and Warner Bros. The integration of Warner Bros.’ extensive library and production capabilities could enhance Netflix’s content offerings and attract new subscribers.

However, some industry experts have raised concerns about the implications of such a large acquisition. The potential for reduced competition in the streaming market could lead to fewer choices for consumers and higher subscription prices in the long run. Additionally, the integration process itself may present challenges, as aligning corporate cultures and operational practices can be complex.

Impact on Content Creation

The acquisition is expected to have significant implications for content creation within Netflix. With access to Warner Bros.’ extensive library, Netflix can draw on a wealth of established franchises and beloved characters to create new content. This could lead to a resurgence of popular series and films, as well as the development of new projects that leverage existing IP.

Furthermore, the acquisition may enable Netflix to invest more heavily in original programming, as it can utilize Warner Bros.’ production resources and expertise. This could result in an increase in the quantity and quality of content available to subscribers, further solidifying Netflix’s position as a leader in the streaming industry.

Future Prospects

Looking ahead, the acquisition of Warner Bros. presents both opportunities and challenges for Netflix. The integration of such a significant entity will require careful planning and execution to ensure a smooth transition. Netflix will need to navigate the complexities of merging operations, aligning corporate cultures, and managing a diverse portfolio of content.

Moreover, as Netflix expands its reach into theatrical releases, it will need to adapt its business model to accommodate this new dimension of content distribution. This could involve re-evaluating its approach to film releases, marketing strategies, and audience engagement.

Conclusion

In summary, Netflix’s acquisition of Warner Bros. for $82.7 billion marks a significant milestone in the streaming industry. The deal not only enhances Netflix’s content offerings but also positions the company to compete more effectively in an increasingly crowded market. As the acquisition moves forward, the implications for content creation, regulatory scrutiny, and market dynamics will be closely monitored by industry stakeholders.

As Netflix embarks on this new chapter, the entertainment landscape is poised for transformation, with the potential for innovative content and new opportunities for audiences worldwide.

Source: Original report

Was this helpful?

Last Modified: December 5, 2025 at 6:39 pm

2 views