cash app debuts a new ai assistant Cash App has introduced a new AI assistant designed to help users navigate their financial queries more effectively.

cash app debuts a new ai assistant

Overview of Cash App’s New AI Assistant

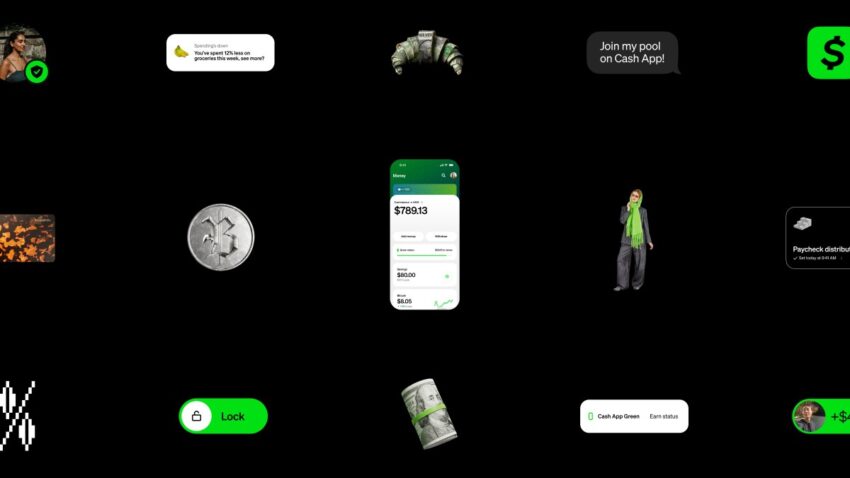

Cash App, a popular mobile payment service developed by Square, Inc., has recently unveiled an innovative AI assistant aimed at enhancing user experience by providing real-time answers to financial questions. This development marks a significant step forward in the integration of artificial intelligence within financial services, reflecting a broader trend in the fintech industry to leverage technology for improved customer engagement.

Features of the AI Assistant

The AI assistant is designed to be user-friendly and intuitive, allowing users to interact with it through natural language queries. This feature is particularly beneficial for those who may not be well-versed in financial jargon or who require quick answers to pressing questions. Key features of the AI assistant include:

- Real-Time Responses: Users can receive immediate answers to their financial inquiries, which can range from transaction details to budgeting advice.

- Personalized Financial Insights: The assistant can analyze user spending habits and provide tailored recommendations, helping users make informed financial decisions.

- Integration with Cash App Services: The AI assistant is seamlessly integrated into the existing Cash App ecosystem, allowing users to access various features without leaving the chat interface.

- 24/7 Availability: Unlike traditional customer service, the AI assistant is available around the clock, ensuring that users can get assistance whenever they need it.

User Interaction and Experience

The interaction model of the AI assistant is designed to mimic a conversational experience, making it accessible for users of all ages and technical backgrounds. Users can ask questions in plain language, and the AI is programmed to understand context and intent, which enhances the accuracy of the responses. This conversational approach not only improves user satisfaction but also encourages more frequent engagement with the app.

Context and Implications of AI in Fintech

The introduction of AI assistants in financial applications is part of a larger trend within the fintech sector, where companies are increasingly adopting advanced technologies to streamline operations and enhance customer service. The use of AI can lead to significant improvements in efficiency, allowing companies to handle a higher volume of inquiries without the need for additional human resources.

Moreover, the implementation of AI in financial services can help address common pain points experienced by users, such as long wait times for customer support and difficulty in finding relevant information. By providing immediate, accurate responses, AI assistants can significantly enhance the overall user experience, fostering customer loyalty and retention.

Market Trends and Competition

The fintech landscape is highly competitive, with numerous players vying for market share. Companies like PayPal, Venmo, and traditional banks are also exploring AI-driven solutions to improve their services. As more financial institutions adopt similar technologies, the pressure will be on Cash App to continuously innovate and differentiate itself from competitors.

In this context, the introduction of the AI assistant is a strategic move for Cash App. It not only enhances the app’s functionality but also positions the company as a forward-thinking leader in the fintech space. By prioritizing user experience through technology, Cash App aims to attract new users while retaining its existing customer base.

Stakeholder Reactions

The launch of the AI assistant has garnered positive feedback from various stakeholders, including users, industry experts, and financial analysts. Users have expressed enthusiasm about the potential for the assistant to simplify their financial management, particularly for those who may feel overwhelmed by the complexities of personal finance.

User Feedback

Initial user feedback indicates that many find the AI assistant’s ability to provide quick answers to financial queries particularly valuable. Users have reported that they appreciate the personalized insights offered by the assistant, which help them better understand their spending habits and make informed decisions. This positive reception is crucial for Cash App as it seeks to build a loyal user base.

Industry Expert Opinions

Industry experts have also weighed in on the significance of Cash App’s new feature. Many believe that the integration of AI into financial services is a game-changer, as it democratizes access to financial advice and resources. Experts argue that this technology can empower users to take control of their finances, potentially leading to better financial outcomes.

Furthermore, analysts suggest that Cash App’s move could set a precedent for other fintech companies. As more firms recognize the value of AI in enhancing customer experience, we may see a wave of similar innovations across the industry.

Challenges and Considerations

While the introduction of the AI assistant presents numerous advantages, it is not without challenges. Cash App must navigate several considerations to ensure the successful implementation and adoption of this technology.

Data Privacy and Security

One of the primary concerns surrounding AI in financial services is data privacy and security. Users must feel confident that their personal and financial information is protected when interacting with the AI assistant. Cash App will need to implement robust security measures and transparent data handling practices to build trust with its users.

Accuracy and Reliability

Another challenge lies in ensuring the accuracy and reliability of the AI assistant’s responses. Users will expect precise answers to their queries, and any inaccuracies could lead to frustration or mistrust. Continuous training and updates to the AI model will be necessary to maintain high standards of performance.

User Education

For the AI assistant to be effective, users must understand how to utilize its features fully. Cash App may need to invest in educational resources, such as tutorials or FAQs, to help users navigate the new functionality. This effort will be essential in maximizing user engagement and satisfaction.

Future Prospects

The introduction of the AI assistant is just the beginning for Cash App. As technology continues to evolve, the company has the opportunity to expand its offerings further. Future developments could include enhanced predictive analytics, allowing the assistant to provide proactive financial advice based on user behavior and market trends.

Additionally, Cash App could explore partnerships with other financial institutions or technology providers to enhance the capabilities of its AI assistant. Such collaborations could lead to the integration of new features, such as investment advice or credit score monitoring, further enriching the user experience.

Broader Implications for the Fintech Industry

The successful implementation of AI assistants in financial applications could have broader implications for the fintech industry as a whole. As more companies adopt similar technologies, we may witness a shift in how financial services are delivered. This evolution could lead to a more personalized and user-centric approach, where technology plays a central role in shaping customer interactions.

Moreover, as AI continues to advance, the potential for automation in financial services could increase, leading to greater efficiency and cost savings for companies. This shift may also result in a redefinition of traditional roles within the industry, as companies adapt to new technologies and customer expectations.

Conclusion

Cash App’s introduction of an AI assistant represents a significant advancement in the integration of technology within financial services. By providing users with real-time answers to their financial questions, the app aims to enhance user experience and foster greater engagement. While challenges remain, the potential benefits of this innovation are substantial, not only for Cash App but for the broader fintech industry. As technology continues to evolve, the future of financial services may be increasingly shaped by AI-driven solutions that prioritize user needs and preferences.

Source: Original report

Was this helpful?

Last Modified: November 13, 2025 at 4:36 pm

3 views