ai-generated receipts make submitting fake expenses easier Recent advancements in artificial intelligence have made it easier for employees to submit fraudulent expense receipts, raising concerns for businesses and expense management platforms.

ai-generated receipts make submitting fake expenses easier

The Rise of AI-Generated Receipts

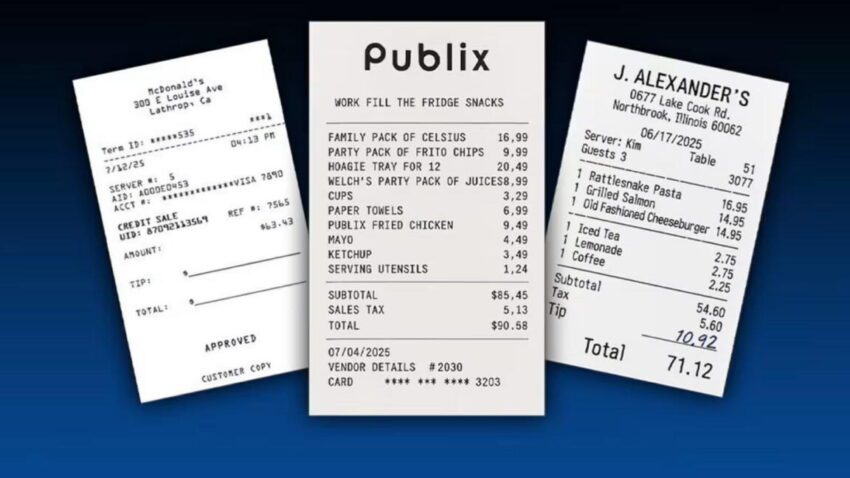

In an era where technology is rapidly evolving, the introduction of sophisticated image-generation models by leading AI organizations such as OpenAI and Google has transformed various sectors, including finance and expense management. These models are capable of producing highly realistic images, including receipts that can easily deceive even the most vigilant of auditors. This technological advancement has led to a notable increase in the submission of fake expense receipts within companies.

Understanding the Technology Behind AI-Generated Receipts

AI-generated receipts are created using advanced algorithms that can mimic the appearance of genuine receipts with remarkable accuracy. These algorithms analyze vast datasets of real receipts to understand their structure, formatting, and common elements. As a result, the generated receipts often include realistic details such as store logos, itemized lists, and even timestamps that match typical transaction patterns.

The implications of this technology are significant. While it can be harnessed for legitimate purposes, such as creating templates for small businesses or aiding in expense tracking, it has also opened the door for fraudulent activities. Employees seeking to exploit this technology can easily generate convincing fake receipts, undermining the integrity of expense reporting systems.

Statistics Highlighting the Problem

Recent reports from leading expense management software platforms reveal alarming statistics regarding the prevalence of AI-generated fraudulent receipts. AppZen, a prominent software provider specializing in expense management, reported that fake AI receipts accounted for approximately 14 percent of fraudulent documents submitted in September 2025. This figure is striking, especially when compared to the previous year, where instances of such fraud were virtually nonexistent.

Furthermore, fintech company Ramp has also observed a surge in fraudulent activities linked to AI-generated receipts. Their software flagged over $1 million in fraudulent invoices within just 90 days of its implementation. These figures underscore the growing threat that AI-generated receipts pose to businesses, highlighting the urgent need for enhanced detection methods and preventive measures.

The Impact on Businesses

The rise of AI-generated receipts has significant implications for businesses of all sizes. Companies rely heavily on accurate expense reporting to manage budgets, reimburse employees, and maintain financial integrity. When employees submit fake receipts, it can lead to substantial financial losses and undermine trust within the organization.

Moreover, the time and resources required to investigate fraudulent claims can divert attention from core business activities. Finance teams may find themselves overwhelmed with the need to scrutinize receipts more closely, leading to increased operational costs and potential delays in processing legitimate expenses.

Stakeholder Reactions

As the issue of AI-generated receipts gains traction, various stakeholders are voicing their concerns and proposing solutions. Expense management software providers, in particular, are at the forefront of addressing this challenge. Many are investing in advanced fraud detection technologies that leverage machine learning and AI to identify suspicious patterns in expense submissions.

Innovative Solutions from Expense Management Platforms

In response to the growing threat of AI-generated fraud, companies like AppZen and Ramp are developing innovative solutions aimed at enhancing the accuracy of expense reporting. These solutions often include:

- Machine Learning Algorithms: By analyzing historical data, these algorithms can identify anomalies in expense submissions, flagging receipts that deviate from typical patterns.

- Image Recognition Technology: Advanced image recognition tools can compare submitted receipts against known templates, helping to identify inconsistencies that may indicate fraud.

- Real-time Monitoring: Continuous monitoring of expense submissions allows for immediate flagging of suspicious activity, enabling companies to respond quickly to potential fraud.

These technological advancements not only enhance the detection of fraudulent receipts but also streamline the overall expense reporting process, making it more efficient for both employees and finance teams.

Legal and Ethical Considerations

The rise of AI-generated receipts also raises important legal and ethical questions. As businesses grapple with the implications of this technology, they must consider how to balance the benefits of AI with the potential for misuse. Companies may need to implement stricter policies regarding expense reporting and establish clear guidelines for employees to follow.

Additionally, organizations may face legal challenges if they fail to adequately address fraudulent activities. In cases where employees submit fake receipts, companies could be held liable for financial losses, leading to potential lawsuits and reputational damage.

Best Practices for Businesses

To mitigate the risks associated with AI-generated receipts, businesses can adopt several best practices:

- Implement Robust Expense Policies: Clear guidelines regarding what constitutes acceptable expenses can help employees understand the boundaries and reduce the likelihood of fraudulent submissions.

- Educate Employees: Training sessions on the ethical implications of expense reporting and the consequences of fraud can foster a culture of integrity within the organization.

- Utilize Advanced Technology: Investing in expense management software that incorporates AI and machine learning can significantly enhance fraud detection capabilities.

- Regular Audits: Conducting periodic audits of expense reports can help identify patterns of fraud and reinforce accountability among employees.

The Future of Expense Reporting

As AI technology continues to evolve, businesses must remain vigilant in their efforts to combat fraudulent activities. The emergence of AI-generated receipts is just one example of how technology can be both a tool for efficiency and a potential source of risk. Companies that proactively address these challenges will be better positioned to maintain financial integrity and trust within their organizations.

Looking ahead, the landscape of expense reporting is likely to change significantly. As AI tools become more sophisticated, businesses will need to adapt their strategies to stay ahead of potential threats. This may involve not only investing in advanced detection technologies but also fostering a culture of transparency and ethical behavior among employees.

Conclusion

The rise of AI-generated receipts presents a complex challenge for businesses, requiring a multifaceted approach to address the risks associated with fraudulent expense submissions. By leveraging technology, implementing robust policies, and fostering a culture of integrity, companies can navigate this evolving landscape and protect their financial interests.

Source: Original report

Was this helpful?

Last Modified: October 27, 2025 at 7:37 pm

0 views